Summary

This article highlights the latest updates and enhancements to the BNTouch CRM platform. Learn about innovative tools designed to streamline workflows, improve client engagement, and increase team efficiency. By the end, you’ll know how to leverage these new features to elevate your mortgage business.

At BNTouch, we’re always striving to enhance our platform and provide you with the best tools to manage your mortgage business efficiently. We’re excited to announce several new features that will improve functionality and user experience. Here’s a detailed look at what’s new:

Spanish Version of Loan Application

We’re thrilled to introduce the Spanish version of our Borrower Portal 1003 Application on the web (note: this feature is not available on the mobile app version of the portal). Now, borrowers can easily switch between English and Spanish using the option located in the upper-right corner of the application screen. This update ensures that borrowers can complete their applications in their preferred language, enhancing accessibility and user satisfaction.

Custom Templates for Portal Invites

Personalization is key, and we’ve expanded the Default Email Templates page to include new options under Other Default Templates. You can now create custom email templates for the following portal invitations:

- Invite to Portal for Borrower

- Invite to Portal for Borrower with Password

- Invite to Portal for Partner

- Invite to Portal for Partner with Password

These new options allow you to tailor your communication, providing a more personalized and engaging experience for borrowers and partners.

UTM Tracking Codes

Understanding where your web traffic comes from and how it’s behaving is crucial for effective marketing. We’ve introduced UTM tracking codes, which are snippets of text added to the end of a URL, to help you track the performance of your digital marketing campaigns.

Setting Up UTM Tracking

It’s easy to set up UTM tracking with BNTouch. You only need:

A website with a BNTouch webform.

A code snippet added to the footer of your website.

Once these are in place, webform submissions will include tracking details about the visitor. This information will be displayed dynamically on the Mortgage Info tab located at Mortgages > Mortgage Info. If no UTM tracking data is available, the section will not appear.

Reporting for Phone Number Validation

We’ve added a new tab in the Phone Validations page (Options > Phone Validations) that allows you to pull validation results based on database selections. The available database filters include:

- Period

- User (dropdown, checkbox)

- Phone Number

- Opted-out Numbers Only (checkbox)

- Filter

- Clear

- Pagination

This feature helps you manage and validate phone numbers more effectively, ensuring better communication with your clients.

ADA Compliance for Corporate Sites

ADA compliance is essential for ensuring that your website is accessible to all users, including those with disabilities. We’re proud to announce that all BNTouch-provided websites now come with ADA compliance built in automatically. You’ll notice a blue and white icon in the lower corner of each site. This icon allows users to interact with and manipulate the accessibility features of the website, adhering to the Americans with Disabilities Act Standards for Accessible Design.

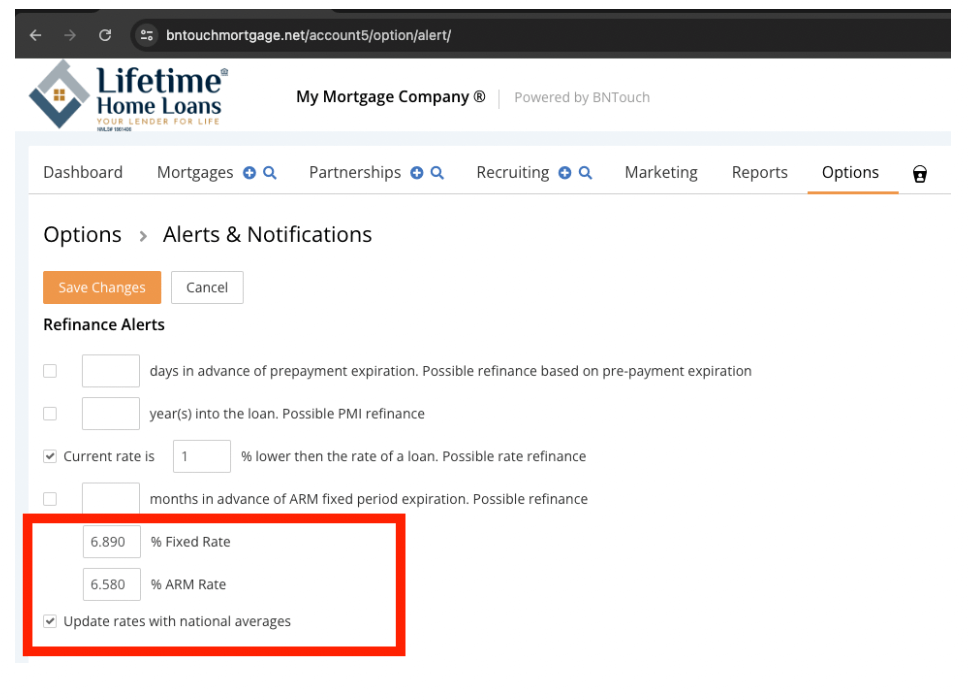

Auto Update of Rates from the Refi Monitor

Staying updated with the latest rates is crucial. We’ve added a new feature on the Alerts & Notifications page (Options > Alerts & Notifications) with a checkbox labeled “Update rates with national averages.” When selected, this option will automatically update your Fixed Rate and ARM Rate daily based on the latest national average rates.

These updates and new features are designed to enhance your experience with BNTouch CRM, making it easier for you to manage your mortgage business effectively. We hope you find these improvements valuable. As always, if you have any questions or need assistance, please don’t hesitate to reach out to our support team.

Demo BNTouch today and learn more about how we can support your business growth.

Key Takeaways

- Enhanced Automation Capabilities

Automate repetitive tasks with improved tools, saving time and reducing errors.

- Improved Client Engagement Tools

Access new ways to connect with borrowers, including personalized messaging and streamlined document sharing.

- Team Collaboration Features

Leverage updated tools for better internal communication and task coordination.

Commonly Asked Questions

- What are the major updates in BNTouch’s new features?

Enhanced automation, improved client engagement tools, and advanced team collaboration capabilities.

- How do these updates improve client engagement?

By offering personalized messaging options and easier document sharing to build stronger client relationships.

- What makes the automation capabilities stand out?

They simplify repetitive tasks, reduce human error, and allow users to focus on more strategic activities.

- How can teams benefit from the collaboration features?

They can communicate more effectively and coordinate tasks seamlessly, improving overall efficiency.