Summary

This article provides practical tips for choosing the right mortgage software. Learn what to prioritize, including scalability, user-friendliness, and integration capabilities. The article emphasizes how the right software simplifies processes and supports growth. By the end, you’ll be equipped to make informed decisions that align with your business goals and operational needs.

If it’s been a while since you’ve looked at mortgage software or a contact relationship management software program for your mortgage business, a lot has changed. In fact, thanks to new technologies, Today’s best CRM platforms have undergone a quantum leap in just a few short years.

Thanks to large language models and predictive learning technologies, the top CRM products today offer significantly enhanced features and usability for busy mortgage pros.

Here are some of the new technologies and recent innovations that are transforming mortgage sales management as of 2024:

Mortgage-specific Artificial Intelligence and Machine Learning

Modern CRMs now leverage artificial intelligence (AI) and machine learning to provide smarter, more personalized customer interactions. AI-driven features can analyze customer data to predict behaviors, suggest the best times to contact leads, and automate routine tasks. This reduces manual work and increases efficiency.

Enhanced Automation for Mortgage Brokers

Automation capabilities have expanded considerably. CRMs now offer more sophisticated workflow automation, enabling users to set up complex, multi-step processes that trigger based on specific actions or events. This includes automating follow-up emails, scheduling tasks, and generating reports, which helps streamline operations and reduce the potential for human error.

Advanced Analytics and Reporting

The latest CRMs come equipped with advanced analytics and reporting tools that provide deeper insights into customer behavior and sales performance. These tools often include customizable dashboards, real-time data updates, and predictive analytics, allowing businesses to make data-driven decisions with greater accuracy.

Improved User Experience

User experience has become a primary focus for CRM developers. Modern CRMs feature more intuitive and user-friendly interfaces, making them easier to navigate and use. Mobile accessibility has also improved, with many platforms offering robust mobile apps that allow users to manage their CRM on the go.

Better Integration with Other Technologies and Platforms

Integration capabilities have expanded, allowing CRMs to seamlessly connect with a wide range of third-party applications and services. This includes integration with social media platforms, marketing automation tools, email services, and even Internet of Things (IoT) devices. These integrations enable businesses to have a more holistic view of their customer interactions and streamline workflows across different systems.

Enhanced Security and Compliance

With growing concerns about data privacy and security, CRMs have enhanced their security features to protect sensitive information. Modern CRMs offer advanced encryption, multi-factor authentication, and compliance with global data protection regulations like GDPR and CCPA. This ensures that customer data is handled securely and in accordance with legal requirements.

Personalization and Customization

Today’s CRMs provide greater customization options, allowing businesses to tailor the platform to their specific needs. This includes customizable fields, layouts, and workflows. Personalization features enable CRMs to deliver more targeted and relevant content to customers, improving engagement and satisfaction.

Customer Self-Service

Many CRMs now include customer self-service portals, where clients can access information, submit inquiries, and resolve issues on their own. This not only enhances the customer experience but also reduces the workload on customer service teams.

Voice and Conversational Interfaces

Voice recognition and conversational interfaces have started to become a part of CRM systems. Features like voice-to-text, voice commands, and chatbots powered by natural language processing (NLP) enable users to interact with the CRM more naturally and efficiently.

LEARN MORE: Read About the Very Latest Innovations and Mortgage CRM Product Enhancements at BNTouch.

These advancements have made CRMs more powerful, versatile, and essential tools for businesses. By incorporating these new features, modern CRM platforms help organizations enhance their customer relationships, streamline operations, and drive growth more effectively than ever before.

SECTION 1: Why You Need Mortgage Software

Mortgage CRMs are designed with features that cater specifically to the mortgage industry. This includes functionalities like loan pipeline management, automated compliance checks, document management tailored to mortgage requirements, and integration with loan origination systems (LOS). These features are essential for streamlining the mortgage process, something a general CRM may not provide.

Compliance and Regulatory Requirements

The mortgage industry is heavily regulated, requiring strict adherence to compliance standards and data security protocols. Mortgage-specific CRMs are built with these regulations in mind, offering tools to ensure compliance with laws such as the Real Estate Settlement Procedures Act (RESPA), the Truth in Lending Act (TILA). And CCPA.

In contrast, general sales CRMs without a built-in mortgage focus lack the necessary features to fully support these compliance needs. Again, this leaves you dangerously exposed to legal and compliance actions.

Mortgage Document Management

Managing documents is a critical aspect of the mortgage process. Mortgage CRMs provide secure and organized document storage, easy retrieval, and sharing capabilities, as well as compliance with document handling regulations. This specialized document management is essential for maintaining efficiency and security, which general CRMs might not adequately support.

SECTION 2: Mortgage CRMs vs. The “Spreadsheet” Approach

If you’ve been managing your contacts using antiquated legacy technology, relying on juggling spreadsheets and email programs, upgrading to a professional-level CRM platform will almost certainly generate a massive improvement in efficiency.

While spreadsheets have been a go-to tool for managing various types of data, CRM programs offer significant advantages, particularly in compliance, risk management, and preventing errors and professional liability.

For example, mortgage software systems automate repetitive tasks such as sending follow-up emails, scheduling appointments, and updating records. This reduces manual work and the potential for human error. In contrast, spreadsheets require manual updates and lack automation capabilities.

A mortgage CRM maintains a comprehensive history of all interactions with customers, including emails, calls, meetings, and notes. This detailed interaction history is crucial for personalized customer service and follow-up, which is challenging to track effectively in a spreadsheet.They also aren’t designed to provide a paper trail for auditing or compliance purposes. In a highly-regulated industry like residential mortgages, the lack of an audit trail could leave you defenseless in case of an enforcement action.

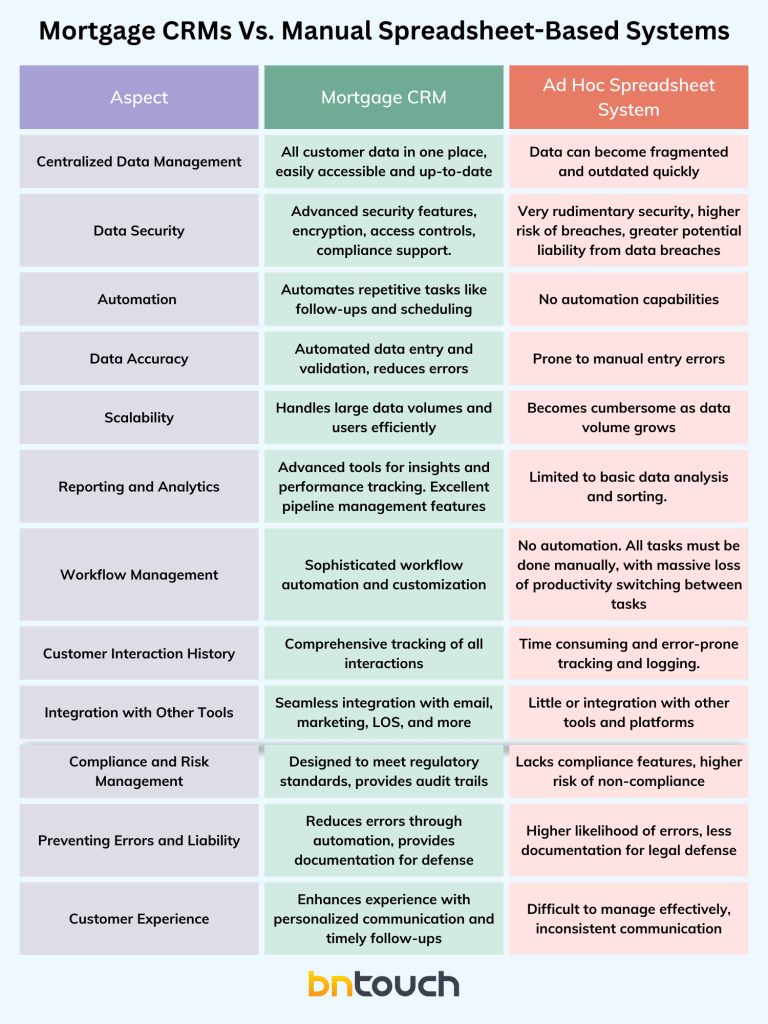

Here are the key reasons why a CRM program is superior to using spreadsheets for managing customer relationships and sales processes:

SUMMARY: Mortgage CRMs vs. Ad Hoc Spreadsheets and Manual Systems

While spreadsheets are useful for simple data tasks, they cannot match the comprehensive capabilities of a CRM program. CRMs provide a centralized, secure, and scalable solution that enhances efficiency, accuracy, compliance, and customer relationships. For mortgage brokers and sales professionals, investing in a CRM is essential for staying competitive, managing customer interactions effectively, and reducing risks associated with errors and regulatory non-compliance.

SECTION 3: What To Expect of a Mortgage CRM in 2024

A mortgage CRM should have specific features tailored to the needs of mortgage brokers and sales professionals. Here are the key features to look for:

Sales Pipeline Management

Historically, sales professionals in all industries often struggled with pipeline management. Too often, good prospects simply “fell through the cracks,” thanks to inconsistent or inadequate follow-up.

A good mortgage CRM will allow you to track all your contacts through every stage of the sales process, from initial contact through the final close. A robust mortgage software platform should offer comprehensive prospect tracking capabilities. Key CRM features include:

- lead scoring to prioritize high-potential clients

- maintenance of detailed client profiles

- automated tracking of interaction history

The best mortgage CRMs automatically log every contact, so you have a history of everything you sent them, every conversation, and every document.

Your mortgage CRM should also make it a snap to generate a variety of reports and forecasts, so you can allocate your time and efforts more efficiently.

Enhanced Communications

Effective communication with clients and prospects is essential. Your CRM should integrate seamlessly with your email and phone systems, enabling you to track all interactions in one place. Automated email follow-ups, text messaging, and prompts to make a phone call help you optimize your time.

Furthermore, personalized communication templates can save time and ensure consistency.

Learn More: Creating Effective and Compliant Mortgage Advertising Strategies

Document Management

Handling documents efficiently is vital in the mortgage industry. Penalties for a breach of sensitive personal or financial information are severe. Look for a CRM that offers secure document storage, as well easy sharing capabilities with those with a legitimate need for access.

Your CRM document management system should support compliance with industry regulations by providing audit trails and secure access controls. This ensures all necessary documents are easily accessible and properly managed throughout the loan process.

Workflow Automation

A mortgage industry-specific CRM should allow you to automate routine tasks and workflows. This includes automated task assignments, customizable workflows, and reminders or notifications for important activities. Automation reduces error rates, increases productivity–especially in switching between tasks, and ensures nothing falls through the cracks.

Reporting and Analytics

Insightful reporting and analytics are essential for making informed decisions. Choose a CRM that offers comprehensive performance metrics and customizable reports. Data visualization tools like charts and graphs can help you quickly understand trends and performance. This enables you to identify strengths, address weaknesses, and make data-driven decisions.

These features are fundamental in a mortgage CRM and can significantly impact your efficiency, client relationships, and overall success. When evaluating CRM options, ensure these key features are present and well-implemented to support your business needs.

SECTION 4: Mortgage CRMs and Cross-Platform Integration

Today’s modern CRM platforms don’t operate in a vacuum.

In years past, CRMs didn’t communicate well with other electronic systems, such as calendars and email systems and document storage services. In legacy systems, this leads to tremendous inefficiency, as users have to constantly toggle back and forth between unconnected systems, and manually transfer information from one platform to another.

Those days are over.

Today’s best mortgage CRM platforms feature built-in, seamless integration with a wide variety of tools and platforms that are essential to your daily operations. Developers throughout the industry have made great strides in facilitating interoperability between different vendors and systems – a process called integration.

Here’s why CRM integration matters and how they can benefit your business:

Email and Calendar Interfaces

Email and calendar integration is fundamental for maintaining organized communication and scheduling. A good mortgage CRM will sync with popular email providers like Outlook and Gmail, allowing you to manage all your emails directly within the CRM. This integration ensures that all client interactions are logged automatically, making it easier to track conversations and follow up promptly. Calendar integration helps schedule meetings, set reminders, and avoid double-booking, keeping your day-to-day operations smooth and efficient.

Today’s CRM platforms should also enable you to integrate automated and scheduled SMS messaging, so you can keep your name in front of your prospects and clients.

Integration with Loan Origination Systems (LOS)

A seamless connection between your CRM and your loan origination system is vital. This integration allows for the automatic transfer of data between the two systems, reducing manual data entry and the potential for errors. It streamlines the loan application process, ensuring that all necessary information is readily available and up-to-date. This efficiency helps in faster loan processing and improves the overall client experience.

Marketing Tools

Marketing is a key component of generating new leads and nurturing existing clients. Mortgage-specific CRMs often integrate with marketing automation tools tailored to the industry. These tools help in creating targeted email campaigns, managing social media interactions, and tracking the effectiveness of marketing efforts.

By integrating different marketing tools, you can automate follow-ups, segment your audience for personalized communication, and gain insights into your marketing ROI.

Ultimately, this leads to more effective lead generation, better client retention, and more effective decision making,

Third-Party Applications

Modern mortgage CRMs support integrations with a variety of third-party applications that enhance their functionality.

- E-signature Management Services: Integrating with e-signature platforms like DocuSign or Adobe Sign simplifies the document signing process. Clients can sign documents electronically, speeding up the approval process and ensuring secure and legally binding signatures.

- Accounting and Financial Management Software: Connecting your CRM with accounting tools such as QuickBooks or Xero streamlines financial management. This integration helps track expenses, manage invoicing, and maintain accurate financial records, which is crucial for budgeting and financial planning.

- Lead Generation Platforms: Integrating with lead generation services like Zillow, LendingTree, or other industry-specific platforms ensures that new leads are automatically imported into your CRM. This integration saves time and ensures that no potential client is overlooked, allowing you to respond to inquiries quickly and effectively.

SUMMARY: Benefits of CRM Integrations for Mortgage Professionals

Integrations enhance the capabilities of your CRM, making it a powerful tool for managing your mortgage business. They help streamline workflows, reduce manual work, and improve accuracy across various processes.

By having all essential tools interconnected, you gain a comprehensive view of your operations, enabling better decision-making and more efficient client management. For mortgage broker principals and sales professionals, these integrations lead to improved productivity, enhanced client satisfaction, and ultimately, increased business success.

In summary, a well-integrated CRM system brings together all the tools you need to manage your mortgage business effectively. From email and calendar synchronization to seamless connections with LOS, marketing tools, and third-party applications, integrations are key to maximizing the benefits of your CRM.

SECTION 5: Ease of Use and Implementation

Using a CRM shouldn’t be difficult. That would defeat the purpose!

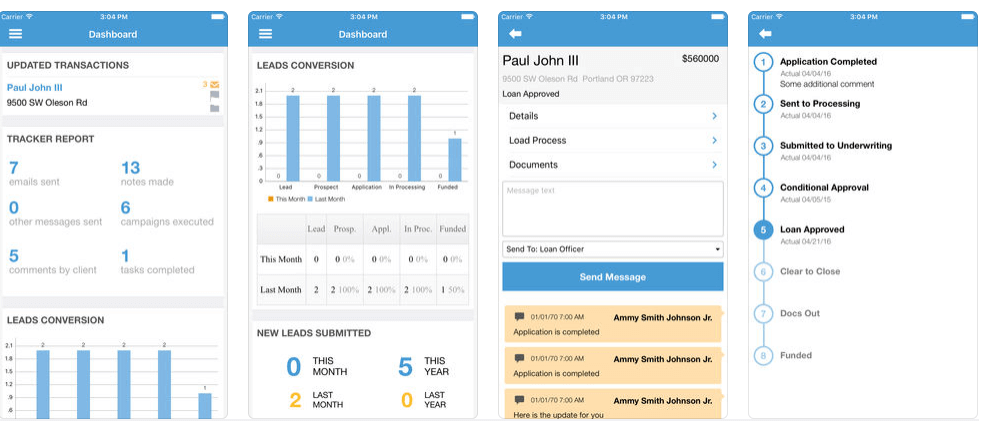

Thanks to new developments in artificial intelligence and predictive technology, today’s CRM platforms are easier than ever to use. The best systems are flexible and intuitive, and enable you to readily access key features in a variety of contexts, both in your office and in the field – even from mobile devices.

Here’s what to consider regarding the ease of use in a mortgage software system:

Onboarding Process

Initial Setup and Customization

The onboarding process should be smooth and straightforward. A good mortgage software will offer an easy-to-follow setup process, allowing you to get started without extensive technical knowledge. Customization is key during the initial setup phase. The CRM should allow you to tailor fields, workflows, and templates to match your specific business needs. This customization ensures that the CRM aligns perfectly with your processes, making it easier for your team to transition.

Vendor Support

Vendor support is invaluable during the onboarding phase. A responsive support team can guide you through the setup process, help troubleshoot issues, and provide insights on best practices. Look for a CRM provider that offers robust onboarding support, including access to a dedicated account manager or implementation specialist who can assist you in configuring the system to meet your requirements.

Training and Documentation

Access to comprehensive training and documentation resources is essential. Training sessions, whether in-person or virtual, help your team understand how to use the CRM effectively. Detailed user manuals, video tutorials, and FAQs can serve as helpful references as you familiarize yourself with the system. The availability of these resources ensures that your team can quickly learn and master the CRM’s functionalities, minimizing downtime and boosting productivity.

Ease of Implementation in Daily Operations

Simplified Data Entry

A user-friendly CRM simplifies data entry, reducing the time spent on manual tasks. Intuitive interfaces and automated data capture features help ensure that information is entered accurately and efficiently. This streamlining of data entry allows your team to focus more on client interactions and less on administrative work.

User-Friendly Interfaces

The design of the CRM’s interface plays a significant role in its ease of use. A clean, intuitive layout with clearly labeled sections and easy navigation helps users find what they need quickly. Customizable dashboards allow users to arrange the information and tools they use most frequently, improving workflow efficiency and user satisfaction.

Mobile Accessibility

In today’s fast-paced environment, mobile accessibility is crucial. A CRM with a robust mobile app allows your team to access client information, manage tasks, and communicate on the go. This flexibility ensures that important activities are not delayed, and your team can remain productive, even when away from the office.

Ongoing Customer Support

Ongoing support from your CRM vendor is vital for maintaining smooth operations. Regular updates, technical support, and access to a support team for troubleshooting issues ensure that the CRM remains functional and efficient. Look for vendors that offer various support channels, such as phone, email, and live chat, to address any concerns promptly.

Cost and Pricing Considerations for Support

This is an important cost consideration. Software-as-a-subscription (SaaS) CRMs tend to feature very good customer support for the long term. Users and managers have ready access to subject matter experts and technicians that can help quickly troubleshoot problems,

With other systems, you buy the program outright, with a single payment, but you may have limited access to ongoing support. With this model, you take on more responsibility for technical mastery of the program. You also may have to purchase upgrades as new features come out.

For more information, see our section on pricing, below.

Training for New Features

As CRM systems evolve, new features and updates are introduced. Continuous training helps your team stay up-to-date with these changes. Regular webinars, workshops, and updated documentation can keep your team informed about new functionalities and best practices, ensuring they can leverage the CRM to its full potential.

User Community and Feedback

Engaging with a user community can provide additional support and insights. Many CRM providers offer forums or user groups where you can share experiences, ask questions, and learn from other users. Providing feedback to the vendor can also help improve the system, ensuring it continues to meet your needs effectively.

SUMMARY: The Importance Ease of Use for Mortgage Professionals

A CRM that is easy to use enhances productivity, reduces errors, and improves overall efficiency. By streamlining daily operations and providing robust support during onboarding and beyond, a user-friendly CRM ensures that your team can focus on what matters most—serving your clients and growing your business.

Section 6: Mortgage Software Security and Compliance

In the mortgage industry, handling sensitive customer information requires a high level of security and strict adherence to regulatory standards. Mortgage CRM software must provide robust security measures and ensure compliance with relevant laws and industry standards. Here’s why security and compliance are essential and what to look for in a CRM system:

Encryption Standards

Data encryption is a critical security feature that protects sensitive information from unauthorized access. Good mortgage software will use advanced encryption standards, such as AES-256, for both data at rest and data in transit. This ensures that customer data is securely stored on servers and protected during transmission between the CRM system and users’ devices.

Secure Communication Channels

Ensuring that all communications within the CRM are encrypted is vital. Look for CRMs that implement SSL/TLS protocols to secure data exchanges between your devices and the CRM’s servers. This prevents interception and unauthorized access to information shared within the CRM, such as emails, documents, and client communications.

Data Backup and Recovery

Regular Data Backups

A reliable CRM should offer automatic, regular data backups to prevent data loss in case of system failures, cyberattacks, or other unforeseen events. These backups should be stored securely and redundantly to ensure that data can be restored quickly and accurately.

Disaster Recovery Plans

In addition to data backups, a comprehensive disaster recovery plan is essential. This plan should outline procedures for restoring data and system functionality in the event of a disaster. A CRM with a robust disaster recovery plan ensures minimal downtime and data loss, maintaining business continuity and protecting client information.

Regulatory Compliance

Compliance with Data Protection Regulations

Mortgage software systems must comply with various data protection regulations such as the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and other relevant laws. These regulations require strict handling of personal data, including obtaining consent, providing transparency about data usage, and ensuring individuals’ rights to access and delete their information.

Audit Trails and Activity Logs

Maintaining detailed audit trails and activity logs is crucial for regulatory compliance. These logs track all actions within the CRM, such as data access, modifications, and user activities. This transparency helps demonstrate compliance during audits and provides an essential record in case of disputes or investigations.

Compliance with Mortgage Industry Standards

Adherence to Industry Regulations

Mortgage software must adhere to specific industry regulations, such as the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA). These regulations govern various aspects of mortgage lending, including disclosure requirements, fair lending practices, and the handling of borrower information. A compliant CRM ensures that all processes align with these regulations, reducing the risk of legal issues and penalties.

Secure Document Management

Managing documents securely is vital in the mortgage industry. Look for CRMs that offer secure document storage, access controls, and encryption for all documents. This ensures that sensitive information, such as loan applications and financial statements, is protected from unauthorized access and complies with industry standards.

Privacy and Consent Management

CRMs should include features for managing customer privacy and consent, ensuring compliance with regulations that require explicit consent for data processing. These features help track and manage consent, providing transparency and protecting customers’ privacy rights.

SUMMARY – CRM Security and Compliance Benefits for Mortgage Professionals

In summary, security and compliance are paramount when selecting mortgage software.

Advanced encryption standards, regular data backups, disaster recovery plans, and adherence to data protection and industry regulations are essential features. By prioritizing these aspects, you can ensure that your CRM provides a secure environment for managing sensitive customer information and supports compliance with all relevant laws and industry standards.

Implementing a secure and compliant CRM protects your business from data breaches, legal penalties, and reputational damage. It also builds trust with clients, demonstrating that you take their privacy and data security seriously.

GET STARTED NOW: Request a Demo.

Section 7: Pricing

When selecting a mortgage software, understanding the cost structure and evaluating the overall value it provides is essential. A well-integrated CRM can offer significant returns on investment, while failing to adopt a top-quality system can be costly in the long run. Here’s what to consider regarding the cost of mortgage software:

Pricing Models

Subscription-Based Pricing

Most CRM providers offer subscription-based pricing, which involves a recurring monthly or annual fee. This model typically includes different tiers based on the features and number of users. Subscription-based pricing provides flexibility, allowing you to scale up or down based on your business needs. It also ensures you have access to the latest updates and features without additional costs.

One-Time Payment

Some CRM solutions offer a one-time payment model, where you pay a single upfront fee for lifetime access to the software. While this can be more cost-effective in the long run, it may not include ongoing updates or support, potentially leading to additional costs for upgrades or technical assistance.

Value for Money

Feature Comparison

When evaluating the cost, compare the features offered by different CRM solutions. Look for essential functionalities such as lead management, automated workflows, document storage, and compliance features. A higher-priced CRM may offer more comprehensive features that provide better value for your business, ensuring you have the tools needed to operate efficiently and effectively.

ROI Analysis

Investing in a CRM should yield a positive return on investment (ROI). Calculate the potential ROI by considering factors such as time saved through automation, improved lead conversion rates, enhanced client relationships, and reduced manual errors. A CRM that boosts productivity and increases revenue can quickly offset its cost, making it a worthwhile investment.

Hidden Costs

Setup Fees

Be aware of any setup fees that may be associated with the CRM. These fees cover the initial configuration, data migration, and customization of the system to fit your specific needs. While setup fees can add to the initial cost, they are often a one-time expense that ensures your CRM is tailored to your business processes.

Maintenance and Upgrades

Some CRMs may charge additional fees for maintenance and upgrades. Ensure you understand what is included in your subscription or one-time payment and whether there are any extra costs for accessing new features or receiving technical support.

Training and Support

Training and support are crucial for maximizing the use of your CRM. Some providers include these services in their pricing, while others may charge extra. Investing in training ensures your team can fully utilize the CRM’s capabilities, while ongoing support helps address any issues that arise.

SUMMARY: Pricing

While pricing is certainly a factor, it’s important to make the decision in terms of the business value a mortgage software program brings. Price is what you pay, but value is what you get.

It’s also important not to get tunnel vision and focus too much on one aspect of pricing. Whether that’s the upfront cost or the monthly subscription fee or per user fees. Keep an open mind, and make your decision based on the total all-in cost versus the total value, both in terms of direct benefits and indirect benefits, such as reduced compliance risk.

Your CRM and automation software is a critical component of your business. Your investment in your CRM may be the most critical decision you make when it comes to your future business growth. It’s the technology and systems backbone of your mortgage business.

For this reason, In most situations, the best move is to select the best mortgage-specific CRM platform you can. Even if you need to tighten your belt when it comes to less business-critical expenditures, an investment in quality mortgage software is very likely to pay significant dividends for years to come.

Learn More: 8 Questions to Ask When Choosing a CRM Software Platform

SECTION 8: The Cost of Not Having a Top-Quality CRM

A good mortgage CRM system can look expensive at first glance. But the lack of a quality mortgage software system is even more expensive. Very expensive.

Failing to integrate a high-quality CRM into your mortgage business can lead to significant inefficiencies. Manual data entry, disorganized workflows, and poor lead management can result in lost opportunities. Much of the cost of poor CRM will be invisible: You may never know how many prospects were falling through the cracks until you finally fully implement a modern CRM system, so you can see the difference yourself: More appointments, more closed deals, more deal flow, more referrals, and more fees and commissions earned.

Here are just some of the costs of delay;

Conclusion

Understanding the cost of a mortgage software involves considering pricing models, evaluating the value for money, analyzing ROI, and being aware of hidden costs. While there may be upfront and ongoing expenses, the benefits of a top-quality CRM far outweigh the costs.

Investing in a robust CRM system is essential for improving efficiency, reducing risks, and enhancing customer satisfaction, ultimately leading to greater business success and profitability.

Key Takeaways

- Prioritize Scalability

Choose software that can grow alongside your business needs.

- Focus on User-Friendly Features

Simplify operations with intuitive tools that enhance productivity.

- Ensure Integration Capabilities

Select software that works seamlessly with existing systems.

Commonly Asked Questions

- What should be prioritized when selecting mortgage software?

Scalability is key to accommodate growth and changing business needs effectively.

- Why is user-friendliness important in software?

Simple interfaces improve team productivity by reducing training time and operational complexity.

- What makes integration capabilities essential?

Seamless integration ensures compatibility with existing tools, optimizing workflows and data sharing.

- What type of businesses benefit most from scalable software?

Firms looking to grow rapidly while maintaining operational efficiency gain the most.