Summary

This article highlights the advantages of using a mobile CRM app for mortgage professionals to manage leads and communications on the go. It covers features like instant notifications, client tracking, and task management that enhance productivity. By using a mobile CRM, professionals can stay connected and responsive anytime, anywhere.

An effective and efficient mortgage CRM and Mortgage Marketing Platform are a cornerstone of a successful lending business. There is no shortage of software solutions. Lenders are faced with having to choose the right platform from a myriad of offerings.

The right mortgage marketing software will help an organization or individual stay with that prospect throughout the customer journey until their Zero Moment of Truth. That moment in which they finally select the company and loan officer they are going to use to buy or refinance their home.

Nurturing leads with automation is time efficient and has proven to provide significant ROI. We all know the sales cycle in home buying and refinancing, both of which usually require a mortgage, can be from 30 days to sometimes years for the consumer to finally take that step and start the loan application.

The good news; There are a lot of choices out there. The bad news; There are a lot of choices out there. If you have found yourself searching online for the best mortgage marketing platform, you may have become overwhelmed. Typically, you will run a search for “Best Mortgage Marketing Software” and anticipate finding some detailed and helpful guidance online. Unfortunately, that is not the case.

To begin with, an online search for CRM or mortgage marketing software turns up the typical list of search results: Four paid ads at the top of the SERPs and seven organic searches which follow. What you will find is a compilation of CRM reviews or Marketing Software platforms that are not exactly specific to the mortgage industry. This article will help you with that decision-making process with a comparison of the top CRM and Mortgage Marketing Platforms. We chose those which have the best combination of features to assist an enterprise client as well as the individual loan officer handle their marketing and pipeline management functions as well.

6 Mortgage Marketing Software Must-Haves

In order for an origination and marketing solution to be of the utmost value to your loan business, it needs to offer effective handling of critical functions you need to execute as you market for and originate loans. Make sure your final choice of software has the following features:

1. LOS integration.

It should be evident why this is so important. Managing your pipeline needs seamless communication between CRM and LOS. Without this function, it would be a nightmare to have to manually input loan cycle events into your CRM to trigger automation. Your CRM should integrate with the LOS you currently use.

2. Secure Borrower Portal

Manage every step of the loan, including document collection, credit pull etc. Paperwork collection is one of the most tasking parts of loan origination. Having a method which your borrowers can use to upload documents securely and track the process of their loan 24/7/365 will save you time and energy which you can put to better use.

3. POS Tools

Your mortgage marketing software should make it simple for you to originate the loan. A platform which facilitates the point of sale, including secure loan application, credit authorization, credit pull and loan pricing for your borrower, is a major step towards making the loan process a “wow experience”.

4. Marketing Automation

This is another must-have feature which must be part of your CRM and Mortgage Marketing Software solution. We all know that the sales cycle for a borrower is anywhere from 30 days to sometimes years. You need a system and process for staying in touch with those prospects. You need to follow up with your leads using email and text messaging campaigns, email blasts and strategic action plans.

5. Co-Branding

Leverage partnerships with professionals in various industries. Co-Branding with Real Estate agents, insurance agents, home remodeling companies and other industries is a great way to add value to those relationships and in turn, have access to their customers who already trust them. You will inherit and benefit from that trust by association.

Your mortgage marketing software should have a library of built-in, customizable marketing emails as well as other assets you can use to stay top of mind with your prospects, current borrowers as well as strategic business partners.

6. Mobile App

Allow borrowers to “lend on the go”. We know how difficult it is to get a borrower to sit still at your office with their inches-thick binder of well-organized documents. Rarely if ever does this take place. By making a mobile app available, you can have those borrowers submit their documents, keep abreast of their loan application progress, get in touch with the right people and more.

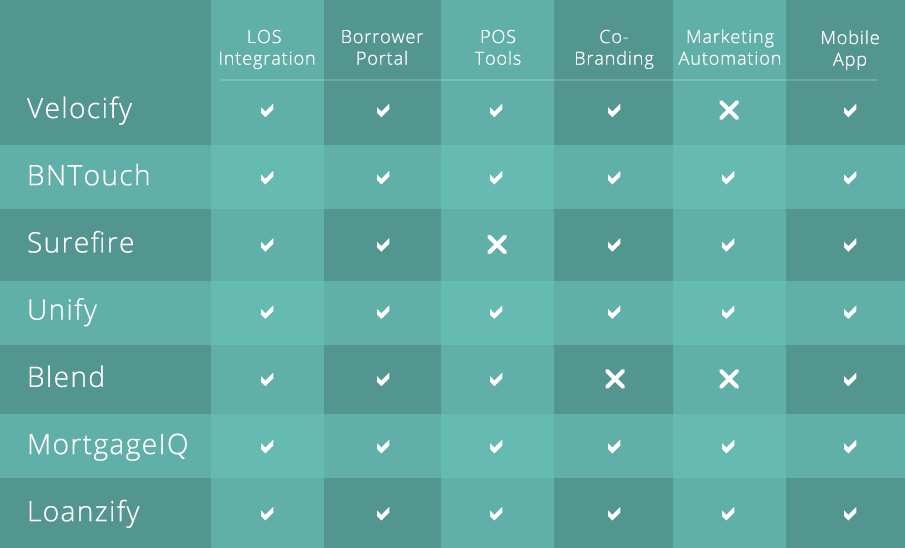

CRM and Mortgage Marketing Software Feature Comparison

Summary review of the top Mortgage CRM Marketing choices:

Velocify

Velocify is an EllieMae company product, known for their “Predictive Dialer” function. Their strength is in the dialer/call center feature.

- Seamless integration with Encompass, also an EllieMae product.

- Some of the largest lenders in the nation use Velocify to respond to leads in seconds. It is primarily an enterprise solution.

- Great solution for enterprise clients who have a call center for which they need the capability to automatically route leads the moment they come in.

- Distribute leads to the first available agent to contact them before they leave that website where they submitted the inquiry. Velocify is a great choice for this environment.

BNTouch

BNTouch is a comprehensive Mortgage CRM and Mortgage Marketing Software offering a unique holistic ecosystem for enterprise clients as well as individual originators.

- Integrate with the top loan origination systems enabling the user to effectively communicate with borrowers and partners at every milestone of the loan process.

- Co-marketing function to efficiently and effectively serve the user’s prospects, borrowers and lending partner relationships.

- Engage prospects at various stages of the customer journey, starting with top of the funnel marketing tools such Email/Text/Voice to engage leads and stay top of mind using their 80+ built in pre-made marketing campaigns.

- Website builder to create websites and landing pages with ease. Users can also enable a custom mortgage chat bot which integrates seamlessly with the website builder.

- A top of the line mobile CRM app and secure document sharing capabilities.

- Free Social Add-On which can be used to easily post content to Facebook and engage with prospect where they are.

- Robust action plans using tasks, create shared to-do lists which are available to borrowers and lending partners.

The availability of the extensive marketing and pipeline management features allow BNTouch to enable its users to do business in a “Blue Ocean” environment instead of having to constantly battle in that “Red Ocean” environment which is so competitive. Users also benefit from state-of-the-art tools to effectively navigate the urgencies of serving the “Now” borrower.

Surefire

Surefire’s strength is their robust email marketing and lead follow up system.

- Integration with the top loan origination systems.

- Borrower mobile app, although it appears that the app is falling short of expectations given their customer reviews.

- Co-branding features with an extensive library of flyers and dynamic video content.

Unify

Unify is a feature rich CRM and Marketing Automation suite.

- Email and direct mail marketing capabilities with co-branding capability.

- Comprehensive marketing library with email templates, flyers and direct mail pieces which can be co-branded with business partners

- Customizable, dynamic video marketing content. They make licensing and disclaimer management easy to implement on all their marketing materials and offer an easy to use analytics dashboard so that the user can track the effectiveness of their digital marketing.

- Integrated phone system option to automatically distribute leads by ringing all available loan officers simultaneously, assigning the lead to first responder.

Blend

The Blend platform offers a great POS and pipeline management system with a very visual and aesthetically pleasing user interface.

- The company claims an industry best 80% pull-through rate on their online loan application.

- Integration with the most common loan origination systems, as well as pricing, credit and underwriting services.

- Intuitive and easy to use mobile app to connect borrower and loan officer anytime anywhere. Their app offers secure document gathering and provides real-time updates to both, loan officer and borrower.

Their weakness seems to be in the marketing automation side. Based on the information on their website, they make no mention of co-branding capabilities or systematic marketing features. They do integrate with third party CRM systems.

MortgageIQ

MortgageIQ is a comprehensive all in one solution at the enterprise level which can cover all departments of an organization including retail, wholesale and consumer direct.

- Integration with the major loan origination systems, and lead sources such as Zillow and Lending Tree.

- Telephony and dialer modules to simplify inbound and outbound calls.

- Robust marketing and follow-up systems which also offers partner co-branding on their marketing pieces.

- Website builder capable of deploying corporate, branch, team and loan officer websites using a proprietary Content Management System.

- For enterprise clients, the customized dashboards for the various departments allow separate groups to avail themselves of just the data they need for their specific role in the loan process.

Loanzify

The strength of Loanzify lies in their mobile app. They have one of the most user-friendly apps with a beautiful user interface.

- Seamless integration with the major third-party loan origination systems.

- Excellent co-branding capabilities to form those key partner relationships with the Real Estate industry. Loanzify provides Real Estate partners with the ability to inform their potential clients on the fly about loan payments and loan programs.

- User friendly online and mobile 1003, a secure borrower portal and loan timeline reporting.

- Loan officers can price loans, pull credit and do basic functions such as ordering VOE and VOA.

- Customizable websites and landing page builder. A blogging platform allowing loan officers to create unique content they can share with their prospects and lending partners.

The Bottom Line

There is a plethora of solutions for companies and individual loan originators to more effectively and efficiently handle any aspect of the mortgage origination and closing process. The needs of each company and originator are different based on their specific business model.

The best strategy for deciding what is right for you and your organization is to have a consultation with the top solution providers. Be clear about what your objectives are and find a solution which will serve as many of your needs as possible. It is nearly impossible to anticipate that one solution will solve ALL your needs, you would need a custom-built solution and that could prove to be very expensive. At the same time, there will be a solution you can choose without the expense of custom build from the ground up, which will handle those functions that matter in your business.

Key Takeaways

- Centralize marketing efforts with all-in-one tools.

Comprehensive mortgage marketing software simplifies campaign management, automating email, social media, and lead generation activities.

- Track campaign performance in real time.

Monitoring key metrics helps optimize strategies and improve ROI.

- Personalize communication to build stronger client relationships.

Tailored messaging enhances engagement and builds long-term client loyalty.

Commonly Asked Questions

- What are the benefits of using mortgage marketing software?

Mortgage marketing software streamlines various marketing tasks such as lead generation, campaign management, and customer outreach. It allows mortgage professionals to automate repetitive tasks, segment their customer base, and optimize their marketing efforts for greater efficiency and better results.

- How can mortgage professionals use marketing software to increase lead generation?

Marketing software helps mortgage professionals capture leads through customizable landing pages, automated follow-ups, and integration with CRM systems. By analyzing customer behavior and segmenting leads based on their interests and actions, the software ensures a higher conversion rate for potential clients.

- What role does personalization play in mortgage marketing software?

Personalization is a key feature of mortgage marketing software, enabling mortgage professionals to tailor messages to specific customer segments. By delivering relevant content and offers to the right audience, mortgage professionals can create more engaging and successful marketing campaigns.

- How does mortgage marketing software improve client communication?

Mortgage marketing software enhances client communication by automating email campaigns, sending SMS reminders, and tracking interactions. This ensures timely, consistent communication with clients, improving customer satisfaction and increasing the likelihood of repeat business and referrals.