Summary

The article discusses how mortgage email marketing can boost business by helping loan officers connect with leads and clients. It highlights best practices like personalization, automated follow-ups, segmentation, and compelling subject lines to improve open rates. Consistent email campaigns nurture relationships, increase engagement, and drive referrals, making email marketing a cost-effective strategy.

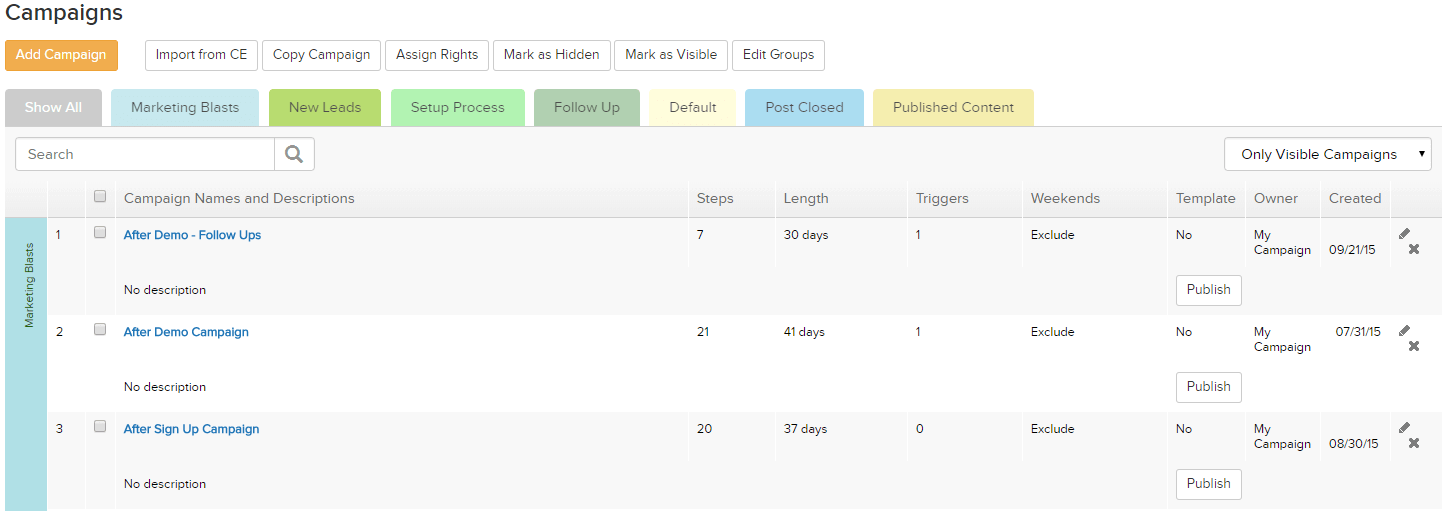

BNTouch is a centralized mortgage email marketing and text marketing automation powerhouse. Our intelligent marketing system will send personalized emails and texts to borrowers, partners, colleagues and others automatically. All you need to do is set it and forget it. Here’s a more specific breakdown of our mortgage email and text marketing features.

Mortgage Email Marketing

-

Centralized Email Marketing Platform

Create all of your emails in one account for all of your marketing activities. No need to recreate the same message for each person in your office. You can allow anyone to modify pre-written materials that you put into the system. -

Personalize Any Email

Use the BNTouch meta tags to merge data into your emails. BNTouch has meta tags for every field in the system so you can write a message once, save it, and BNTouch will fill in the details when it goes to send it. -

Automate Your Emails

BNTouch will automatically send your emails and reminders on the day they are supposed to go out. Don’t leave it up to your sales staff to remember, let BNTouch guide them through your sales process to ensure that your leads don’t fall through the cracks.

-

Email History Log

Every time you send an email, the system records it into a Tracker. You can easily pull-up a history of all emails that have been sent to any borrower or partner. With BNTouch you’ll never miss a beat. -

Analyze Email Performance With Reports

We provide you with a variety of reports that will help you get a better understanding of how your email marketing is performing and which user or branches emails are seeing the most results.

Mortgage Text Marketing

-

New Lead Follow-Up

Most leads that are lost move on within the first few hours of signing up for an offer. A good lead follow up system is crucial to any modern business. Setup a campaign that automatically sends new leads an introductory text message right after they opt-in asking if there are “any questions you can answer for them now”. Then follow that up promptly with an email or any other form of communication.The key to this process is in automating these steps so that you are not wasting any time. When a lead signs up they’ll get an email and text message automatically, that means you’ve now touched that lead twice without lifting a finger.

-

In-Processing Updates

Nothing will make a borrower happier than quick updates about the status of their loan application. SMS Marketing is perfect for this task as you can set text alerts to go out when a borrowers application hits certain milestones. Send a text when an application; is submitted, requires more documents, is approved, or is cleared to close. This will keep your borrowers happy with real time updates and allow them to quickly respond when their attention is required on any part of their loan application. This method can also be used to keep realtor partners up to date on loan applications as well.

-

Refinance Reminders

Easily reach your past borrower database with a text message when a refinance opportunity arises. Make sure you provide value here start by sending them a video or an article that highlights what they need to know about refinancing as well as letting them know you’re around to answer any questions they may have about the process.

Key Takeaways

Email Personalization Increases Engagement: Tailor emails to clients’ needs to improve response rates.

Automation Saves Time: Automated follow-ups keep communication consistent and effective.

Segmented Campaigns Boost Relevance: Target specific audiences for better results.

Strong Subject Lines Drive Opens: Catchy and clear subject lines improve email open rates.

Consistent Outreach Builds Relationships: Regular emails nurture trust and generate more referrals.

Commonly Asked Questions

How can email personalization improve client engagement?

Personalizing emails by using the recipient’s name or referencing their specific needs makes clients feel valued, increasing engagement and trust. Tailored content ensures the email resonates more, leading to higher response rates.

What are the benefits of automating follow-up emails for mortgage brokers?

Automating follow-ups saves time, ensures consistency, and keeps clients informed at every stage of their mortgage process. It also improves client retention and boosts referral opportunities.

Why is segmenting email campaigns important for targeting the right audience?

Segmenting helps brokers send relevant emails to specific groups, such as first-time buyers or refinancers. This targeted approach increases open rates and conversions.

What strategies help create strong subject lines that increase email open rates?

Effective subject lines are short, clear, and include a sense of urgency or personalization. They should address a client’s needs or highlight a benefit to grab attention quickly.