Summary

This article covers local SEO strategies for mortgage brokers. Learn about optimizing local listings, getting reviews, and using location-based keywords to increase visibility in local search results. By the end, you’ll know how to improve your local online presence and attract more local clients through effective SEO practices.

You’ve worked hard growing your mortgage business. You’ve taken extra care to pay attention to every detail of your client’s loans, making sure it’s the smoothest transaction possible. You’ve spent countless dollars on marketing, building your brand awareness and trying to ensure you are the first person homeowners in your marketplace think of when they think about home financing needs. You’ve developed tons of great online content to educate people about the home buying and financing process, establishing yourself as a thought leader in their minds. So how are your competitors generating more online leads and reviews than you are able to generate for your mortgage business?

The answer, as with everything in life is a bit more simple than it seems. The reality of the situation is they just rank better when it comes to local SEO.

There is a shift going on in online search and consumer behavior. Consumers are shifting their shopping preferences with a focus on engaging experiences in local brick and mortar businesses and as a result, their online search strategies have changed.

Today we’ll take a look at local SEO, what it is, how to optimize your mortgage company’s local SEO strategy and how to track your campaign results.

What is Local SEO?

Local SEO (Local Search Engine Optimization), also known as local search engine marketing, is an incredibly effective way to market your mortgage business online. It is effective because it helps businesses promote their products and services to local customers at the exact time they’re looking for them online.

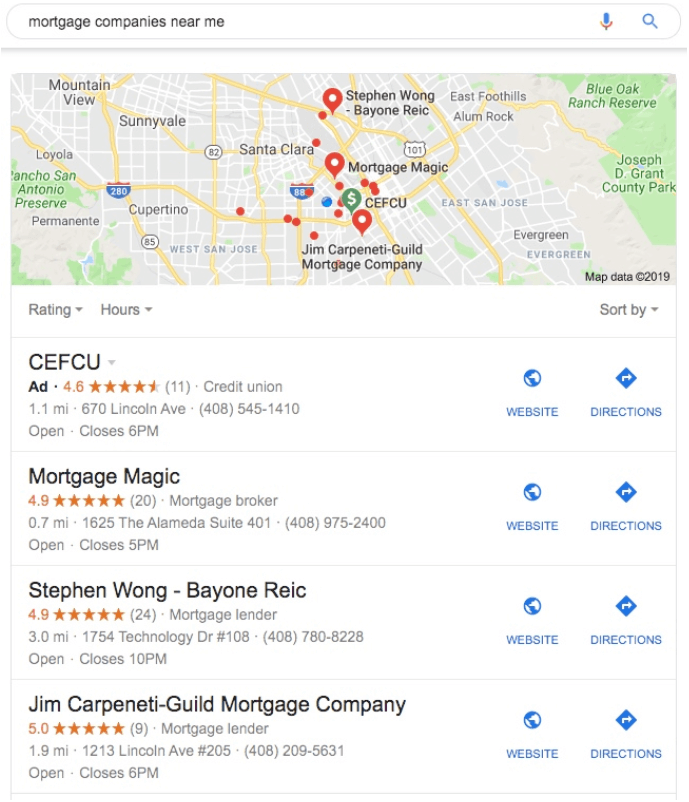

As you can see in the example above, when a user types,”Mortgage Companies” or “Mortgage Companies Near Me”, local search results are the first thing they are shown, so having your local SEO set up is very important to driving traffic to your mortgage company.

If you are thinking, “I have my SEO set up perfectly on my mortgage website so this doesn’t apply to me”, think again. Local SEO best practices and methods differ pretty greatly from standard SEO practices, so you need to make sure your mortgage company is set up and optimized for local SEO as well.

What Is “Local Search” And How Does That Apply To My Mortgage Business?

The reality of the situation though is that according to Google, 46% of searches have a ‘local intent’ and they have optimized their algorithms for this. So if a user lives in Carlsbad, CA for instance and they type in “Jumbo Loan Mortgage Broker”, the first results they are going to receive are going to be results that are local to them. If you haven’t taken steps to set up your local SEO strategy, your competitors that have employed local SEO strategy will be on the top of the search list. Even if you are the #1 ranked standard result for that keyword, Google has prioritized local searches first and will put their #1 local result above yours.

So as you can see, based on local results being prioritized by Google, it is important that your Mortgage company employ both types of SEO strategy to ensure you are getting as much web traffic and new business as possible.

How Do I Know If My Local SEO Is Good?

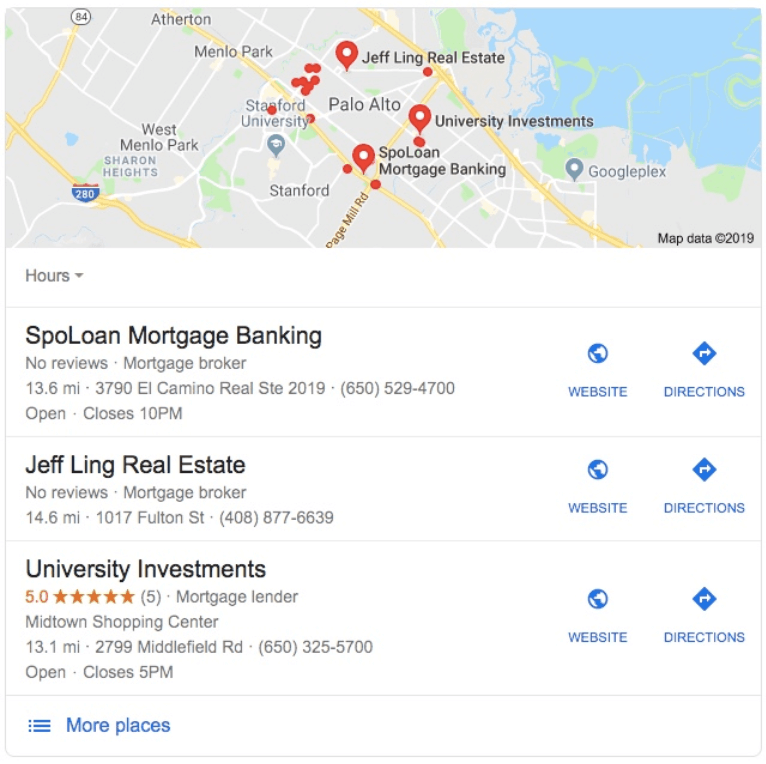

The holy grail for your mortgage business when it comes to local search results is what is referred to as the “3 pack”, or “local pack”. This is a block of the first 3 businesses that appear when a user searches with local intent. To improve traffic to your mortgage company’s website, or to get more leads to actually come to your business itself, you need to be visible on the 3 pack. The rest of the results will only appear when a user clicks to view “More Places”.

To give you an idea of what the 3 pack looks like, below are the local pack search results for the search term “mortgage brokers in Palo Alto, CA”

How To establish Your Mortgage Business In The Local SEO Framework

So, knowing that your potential clients want to work with someone local and are using local SERPS to find what they are looking for, most likely focusing their attention on the local 3 pack, how can you leverage your local SEO strategy with best practices to improve your placement?

For local SEO it really comes down to three main categories, online business listings, reviews, and social media.

-

Google My Business Profile

Whether you have a single mortgage brokerage location or multiple locations, your Google My Business (GMB) Profile is the most important part of your local SEO strategy. Google My Business is Google’s directory of local business listings and it’s where you submit your business to have it appear in local results. Claiming and setting up your google my business page is a fairly straight forward process and it allows you to make sure all your information is 100% accurate. You cannot believe how many businesses have incorrect or missing local listing information. In fact, it’s estimated that nearly $10.3 billion worth of sales are lost every year because of incorrect online business listings.

We’ve created a full Google My Business Setup Guide For Mortgage Offices Here.

Review your online profile regularly to make sure everything is accurate and up to date. Not only that, stay active with your listing. For instance, maybe you close a loan for a new client and you took a “congratulations photo” with them at closing. Go into your GMB listing and upload that into the photos. If you have special hours on the holidays, be sure to log into your listing and update the hours. When you get reviews from clients or get questions posted on your listing, log in and reply to those as well.

The more active you are with your business listing page and the more often you update it, the better rankings your mortgage company will have with local SEO.

-

Reviews

Another vital piece to your local SEO strategy for your mortgage business is effectively managing your customer reviews. Responding to reviews is one of the best things a business can do for their online presence. By responding to both negative and positive reviews, not only does it show customers you care, but it also has been proven that it will increase your search rankings.

In the off chance you get a negative review, remember that you want to acknowledge the feelings of the reviewer, let them know you understand their frustrations, are sorry they feel that way and are committed to making things right for them. Lastly, you’ll want to offer to take the conversation offline to further assist them.

Also of important note, it is okay to ask your clients for reviews. In fact, don’t beat around the bush when it comes to asking for reviews. Send an email directly to your customer specifically asking for a review. Not only that, do it right after you close a deal. You just closed a loan for this customer and they’re undoubtedly happy with the outcome and it’s fresh in their mind. Now is an opportune and perfectly acceptable time to ask for a review.

PRO TIP: The truth of the matter is eventually even the best mortgage companies will receive a bad review (for instance, what if a potential customer applied for a loan but was denied due to credit? They may get upset and vent their frustration online).

Additionally, you may not think this would be, but potential customers are much more likely to do business with a company that has gotten a periodic bad review and handles it correctly. Consumers tend not to trust companies that have a perfect review record because those business listings are deemed in their eyes to be less authentic.

-

Social Media

Social media is a great way for your mortgage company to gain brand awareness online. Brands with great social media presence are likely to bring in more customers. Actively posting and engaging with customers on social media is one of the best ways to build up brand loyalty.

The more you interact with your followers and past clients, the more likely you are to convert them into brand evangelists for your mortgage company, spurring them to recommend you online through a review or even sharing your social media posts with their family and friends. Both these activities relate to engagement, which is a part of what Google analyzes when they are ranking local businesses.

The obvious goal of your local SEO strategy is to improve your Mortgage Company’s local online business rankings. When it comes to local rankings, if your mortgage company is not in the top 3, you’re not relevant. Fighting for that top spot is not easy, which is why it’s so important to take these three factors into account when planning a best practice-driven local SEO strategy.

Key metrics to use to analyze your Mortgage Company’s Local SEO improvement

Accurate tracking, measurement and reporting is mission-critical to ensure the steps your mortgage company is taking with local SEO are actually improving your rankings. The truth is there is a massive treasure of data you can use to do this, but not all metrics are created equal.

To save time and track your metrics as effectively as possible, you should follow a list of specific key performance indicators (KPI’s) that matter the most to your mortgage company’s local SEO strategy. There is a three-step process you can employ to quickly track local search performance, measure the effectiveness of your mortgage company’s local SEO efforts, and analyze results to optimize your future efforts.

We’ve compiled a list of the top Local SEO tools for mortgage businesses.

First, let’s look at the data you want to gather:

-

Check Rankings On Search Engines

Run searches for keywords in all the cities where your mortgage company has locations. For instance, if you have mortgage branches in La Jolla, Palo Alto, and San Francisco, you would want to search for keywords such as:

Mortgage companies in La Jolla

Mortgage companies in Palo Alto

Mortgage companies in San Francisco

(and variations of those main keyword phrases)

Make a list of these so you can go back and check them frequently. While you may not immediately rank high in the rankings for these keyword searches, regularly checking the keywords and monitoring improvement as you are executing your local SEO strategy will give you insight into the health of your local SEO efforts.

-

Ranking On Third-Party Search

Tracking and measuring your performance in organic search is important, but you need to get more granular with local search results, including the 3 pack results. Search for specific keywords on third party sites as well. For instance, how does your mortgage company rank for specific keywords on Zillow, Yelp, Facebook, and other third-party local sites? Google scours the internet to track citations, links and engagement around your website so increasing performance on third-party sites can increase your local SEO performance as well.

-

Citation Consistency Across The Board

A local citation is any online mention of the name, address, and phone number of your mortgage company. Citations can occur on local business websites, on websites and apps, and on social platforms. Citations help Internet users to discover your mortgage business and also impact local search engine rankings. You should frequently check all your citations to ensure data accuracy.

There are many online tools, such as Citation Tracker form Bright Local that you can use to easily locate and review all your businesses online citations.

Feeding incorrect business information or failing to keep listing information current in search engines and data aggregators can lead to a poor user experience. Poor user experiences could lead to bad reviews of your mortgage business. You can see how this can quickly spiral downhill when it comes to your Local SEO efforts success.

-

Number of Reviews per Location And Average Review Ratings

Reviews instill trust and confidence in consumers. The number of reviews your mortgage business has on Google, Zillow, Yelp or Yahoo! can influence consumer perception about the popularity of your business and how your brand ranks over time. Check your number of reviews over time to see if more reviews lead to better rankings.

Of course, with a high number of reviews, you’re also looking for a high overall rating. Tracking and monitoring local review ratings and how they impact your local search ranking is an important source of intelligence that can be used to improve service and operations across the organization. Check your average ratings over time to see if more positive reviews generate better search rankings.

The 3-Step Process to KPI Measurement for Maximum ROI

Now that you know what you need to track and measure, let’s lay out a simple yet effective process to put your newfound local search intelligence to work for your business. You can also check out our full guide on optimizing Local SEO for loan officers.

-

Plan Your Approach

Begin by defining your ROI requirements. How will you define success? This is something that is unique and specific to your overall goals. For instance, you may want to increase the number of new mortgage applications your brokerage gets over the course of a month. So, in that case, you would be tracking the traffic generated from your Google My Business listing that resulted in new mortgage applications.

-

Implement Local Analytics

Measure traffic and click activity across local landing pages by implementing web analytics data that is available in Google Analytics to track goals (such as new leads that applied for a mortgage), click events and conversions. Segment traffic by location and local pages. You also want to segment your traffic by source. For instance, determine whether your traffic came from desktop search, mobile or referrals. This will give you valuable insight into how users are choosing to find your business and engage with your website, allowing you to make better-educated choices when it comes to creating pages and content on your website that will be best optimized for the greatest number of your website visitors.

-

Automate Your Results Tracking

It’s important to track and measure rankings, citations, and reviews across the three major search engines (Google, Yahoo! And Bing), local results, and third-party organic results from sites like Zillow, Yelp and Foursquare.

Tracking across major search engines, data aggregators, and niche directories and sites doesn’t have to be a time-consuming, fragmented process. Ideally, you want to use an automated tool to make your reporting exercise simple, yet rich in detail.

Automating your local reporting gives you quick and easy access to scheduled reports and hyperlocal reporting data. It also allows you to simplify the process of tracking reviews and ratings.

Get Started Today And Get Your Mortgage Company In The 3 Pack

When it comes to Local SEO for your mortgage company, you need to remember that we are talking about a marathon and not a sprint. While results will not happen overnight, if you use the above tips and best practices to plan your strategy, regularly monitor your Google My Business listing, and engage with reviewers and track your growth, you will get there sooner than you think.

Your mortgage company deserves every opportunity to grab the attention of people in your marketplace that need your services. Local SEO is a very powerful tool you can add to your arsenal to help you get there.

Key Takeaways

- Local SEO Improves Visibility

Optimizing your Google My Business profile and using location-based keywords helps increase your visibility for local clients searching for mortgage services.

- Customer Reviews Matter

Positive reviews enhance your reputation and build trust, which is essential for local SEO ranking and attracting new clients.

- Content Optimization for Local Search

Tailoring your website content to include local keywords and relevant services boosts your chances of ranking higher in local searches.

Commonly Asked Questions

- How can Google My Business help improve local SEO for mortgage brokers?

Google My Business allows mortgage brokers to manage their online presence, display essential information, and appear in local searches. Proper optimization enhances visibility and helps attract local clients.

- Why are customer reviews important for local SEO?

Customer reviews build trust and credibility. Positive feedback can influence search engine rankings and help mortgage brokers stand out in local searches.

- What role do local keywords play in SEO?

Using local keywords on your website and content allows your business to rank higher for location-based searches, making it easier for nearby clients to find you.

- How can location-based content impact SEO?

Tailoring your content to reflect local services and areas boosts the relevance of your website for local searches, increasing your chances of ranking higher in search results.