Summary

This article dives into the importance of adapting mortgage lending strategies to cater to different generations—Boomers, Millennials, and Gen Z. Learn about the unique preferences and needs of each group and how mortgage professionals can tailor their approaches to increase engagement and close more deals. By the end, you’ll know how to effectively market to each demographic and improve your lending business.

Mortgage lending looks different for every life stage. How well does your lending practice understand the needs of each generation? Here are some tips for lending to different age groups.

Mortgage Lending for Boomers

Baby boomers represent the generation born between 1946 and 1964. Boomers are unlikely to be searching for a starter home. However, they may have unique needs that your practice can assist with.

Retirement and spending time with family tend to be top priorities. Here’s how lenders can reach this older generation:

- Emphasize help with downsizing/relocating

- Highlight refinancing options

- Provide guidance on the purchase of a second home

- Educate boomers regarding reverse mortgages

Does your practice help with these specific needs? If so, you may stand out among other mortgage lenders.

Boomers aren’t strangers to technology. But lenders may still gain traction through traditional approaches such as:

- Creating written educational content

- Making time for phone calls and face-to-face interactions

- Mailing postcards and fliers

The more you can educate boomers on their available options, the more likely they’ll be to select your services.

Mortgage Lending for Millennials

Millennials, born between 1981 and 1996, are at the prime home-buying age. Many are making a first-time purchase, though they are unsure of how the process works. Others may be seeking advice on refinancing or relocating. Here’s how you can connect with millennials.

- Maintain a strong web presence

- Educate new buyers on the mortgage process

- Use chatbots to communicate in real-time

- Showcase success stories and client testimonials

Lenders should also take time to understand the specific needs of this generation. Millennials may be looking for things like:

- Multi-generational options for growing families

- Lending options for non-traditional employment

- Eco-friendly features and sustainable architecture

Millennials have faced tough times. Many are skeptical that home ownership is even possible. Seek to provide empathy — and guidance. This can assure younger adults that their dream home is still within reach.

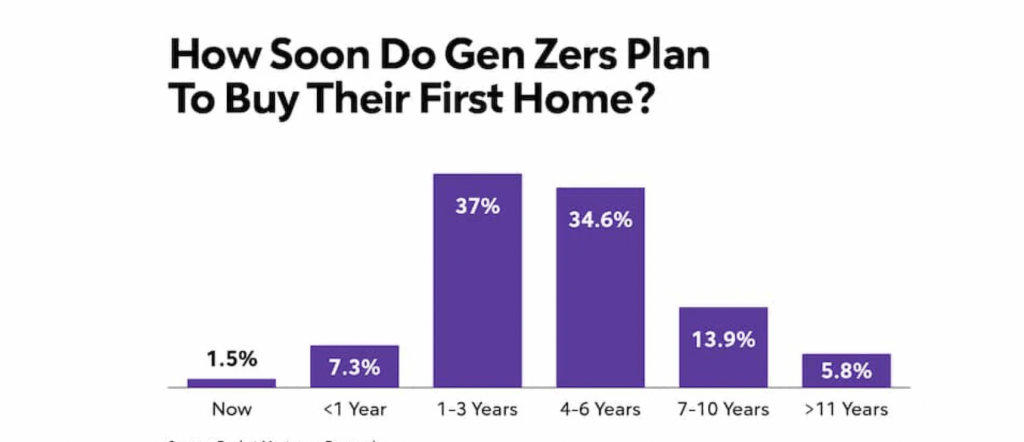

Mortgage Lending for Gen Z

Born between 1997 and 2012, Generation Z represents the newest class of borrowers. Many may be starting the borrowing journey for the first time. Many aren’t even sure where to start. Here’s how you can help:

- Take a digital-first approach (web content, social media, etc.)

- Provide interactive features, such as a mortgage calculator

- Emphasize programs for first-time homeowners

- Provide flexible options

- Inform new leads of eligibility criteria

- Leverage the power of social influencers

Younger generations value authenticity and connection. The more you can showcase your brand identity, the more positively Gen Z will view your brand. A digital platform will make it easier for you and your borrowers to communicate and explore lending options.

Using a Mortgage CRM

Want to make marketing easier? Just use a customer relationship management (CRM) platform. A mortgage CRM can offer you marketing templates, email customization, video content, and more. The BNTouch platform contains these features as well as tools for team collaboration and communication. Want to see it for yourself? Contact BNTouch today to schedule a demo.

Key Takeaways

- Understanding the Unique Needs of Boomers

Boomers often value stability, low-risk options, and face-to-face communication. Mortgage professionals should emphasize personal interactions and offer reliable loan options with clear terms that provide security.

- Tailoring Strategies for Millennials

Millennials prioritize convenience, digital tools, and transparency. Mortgage professionals can appeal to this group by offering online applications, instant pre-approvals, and clear, easy-to-understand communication. Providing tools like mortgage calculators and mobile apps can enhance the experience.

- Appealing to Gen Z’s Digital Savvy

Gen Z is highly tech-savvy and prefers quick, efficient services with minimal effort. Mortgage professionals should utilize social media marketing, chatbots, and instant messaging features to engage this generation.

Commonly Asked Questions

- What are Boomers’ preferences when it comes to mortgage lending?

Boomers generally prefer stability and face-to-face communication. They favor reliable loan options with low-risk factors and clear terms.

- How can mortgage professionals appeal to Millennials?

By offering online tools like mortgage calculators, instant pre-approvals, and ensuring transparent communication, mortgage professionals can cater to Millennials’ desire for convenience and digital access.

- What strategies work best for engaging Gen Z in mortgage lending?

Gen Z values digital efficiency, so using social media, chatbots, and video consultations will attract this generation. Providing quick and easy services is key.

- Why is it important to tailor mortgage lending approaches for different generations?

Different generations have distinct preferences and needs, so adapting strategies helps mortgage professionals connect more effectively with each group, leading to better engagement and higher conversion rates.

To learn more or schedule a demo, contact BNTouch today.