Summary

This article highlights how using an effective CRM system can help mortgage brokerages streamline their operations and improve efficiency. Learn about key CRM features, how they support business growth, and how automation can save time and reduce errors. By the end, you’ll know why a robust CRM is essential for scaling your mortgage business.

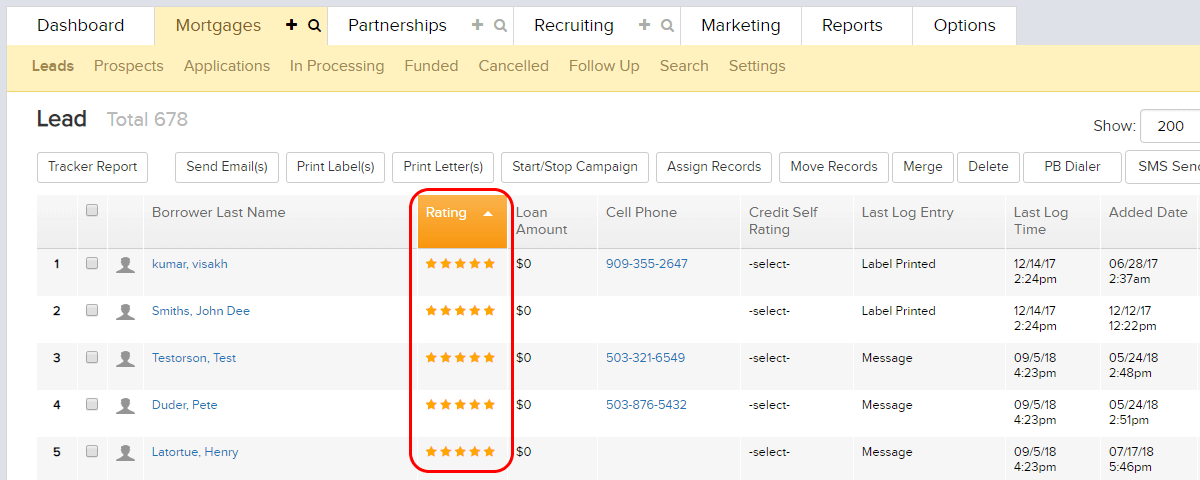

Not all records are created equal. We’ve officially added a star rating system into the “Mortgages” and “Partnerships” tab. Give any record in your database a star rating based on any criteria. Manually rate mortgage leads on how easy they seem to work with. How quickly they respond and send documents. Or how able they are to easily qualify for a high dollar loan. The possibilities are endless. You’ll also certainly be able to toggle star ratings on and off for any user groups as well as sort records by their star rating.

Here is an in depth breakdown of what exactly you’ll be able to start doing with these star ratings. Along with what other features and capabilities this new update offers.

Sort Leads By Rating

Easily sort leads, prospects or in-processing records by their rating with a simple click of the mouse. This will allow your sales team to get a quick visual representation of top priority records that need to be nurtured. Maybe at the end of each year you want to go through all the lowest rated leads to see if any circumstances have changed. Or improve their rating and move them forward in the pipeline.

Enable/Disable Ratings By User Group

Don’t need everyone in the office to know what each record has been rated? Admins can enable or disable the star rating for different user groups within their mortgage office. Ratings can be enabled for just the sales team to help them prioritize follow-up and create a more effective lead flow. Every office may want to use these ratings differently so we’ve left enough freedom that you can set up this tool however it’s most beneficial to your team.

We hope you get a lot of value out of this simple star rating system. We’ve have big plans for it down the line. The possibility of adding an automated lead scoring system that can be used to automatically give all records a star rating. The rating would be based on how much they interact with your marketing material. We may also look into adding a campaign trigger for users above a certain star rating. Essentially allowing you to send out marketing to the highest rated or priority contacts with ease.

Finally we want to know if you have a creative way that you’re using these star ratings that we haven’t thought of. We’d love to hear about it in the comments.

Key Takeaways

- RM Enhances Organization

Using a CRM system helps organize client data and communications, making it easier to track leads, follow-ups, and loan status. This leads to fewer missed opportunities and improved client satisfaction.

- Automation Saves Time

Automating daily tasks like sending reminders, scheduling follow-ups, and managing emails saves significant time for brokers. This automation ensures that no lead is forgotten and every client gets timely responses.

- Improved Client Relationships

A CRM allows brokers to better understand their clients’ needs and preferences. By leveraging this data, brokers can personalize interactions and build stronger, more trusting relationships, ultimately increasing conversions.

Commonly Asked Questions

- What is the benefit of using a CRM for a mortgage brokerage?

A CRM system helps organize client data, track communications, and automate tasks, making the brokerage more efficient and responsive to client needs.

- How does automation in a CRM save time?

Automation takes care of routine tasks like reminders and follow-ups, freeing up time for brokers to focus on high-priority activities.

- Can a CRM improve client relationships?

Yes, by storing detailed client information, a CRM allows brokers to personalize communication, leading to stronger relationships and higher conversion rates.

- How does a CRM contribute to business growth?

A CRM system helps brokers manage leads more effectively, automate tasks, and improve client engagement, leading to increased productivity and business growth.