Summary

This article explains how mortgage professionals can leverage the Mortgage Tracker tool and its triggers to streamline operations and improve client communication. Learn about setting up automated alerts and triggers to notify you when important events occur in a loan’s lifecycle. By the end, you’ll know how to enhance your workflow and client satisfaction with this powerful tool.

We’ve got an exciting new update this week and it has to do with your communication tracker. You know that thing in BNTouch that keeps track of every time you call or email a partner. That let’s you know what forms your borrowers have filled out or what marketing they’ve clicked on.

![]()

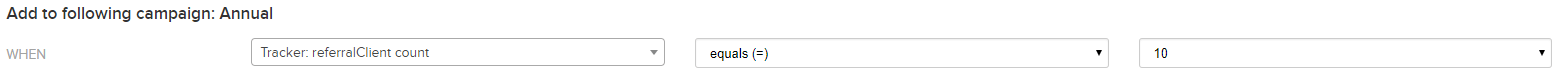

Well you’ll now be able to create campaign triggers that will automatically add your partners and borrowers to campaigns based on what’s logged in their communication tracker.

How Can You Use Tracker Triggers?

-

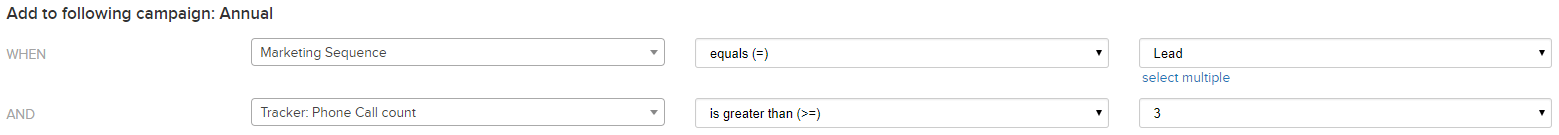

Call Count Trigger

Want a specific piece of mortgage content that highlights what differentiates you from the competition to automatically go out to a potential borrower that you’ve called more than three times? Setup a Tracker Trigger that will add Leads to your campaign when the tracker shows a call count greater than or equal to 3. -

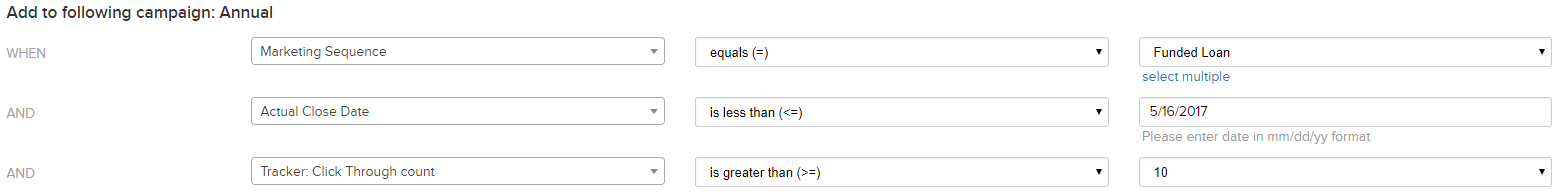

Click Through Trigger

Want to send a refinance packet to one of your past borrower who seems to be engaging with a lot of your marketing recently? Setup a Tracker Trigger that will add borrowers with funded loans that closed over a year ago and have click through 10 or more of your emails. -

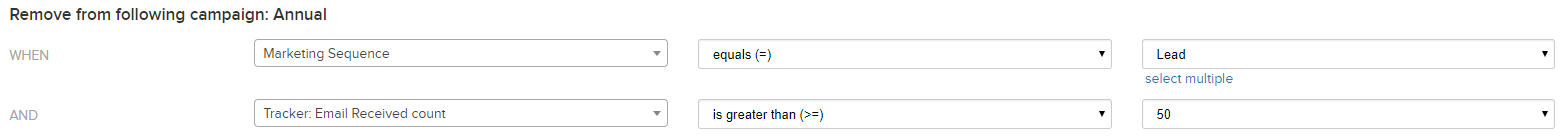

Remove Inactive Accounts

Want to remove inactive accounts from one of your long running campaigns in order to see more accurate reports and statistics from that campaign? Setup a Tracker Trigger that removes leads from a campaign that have received 50 or more emails from you and haven’t progressed to the application process. -

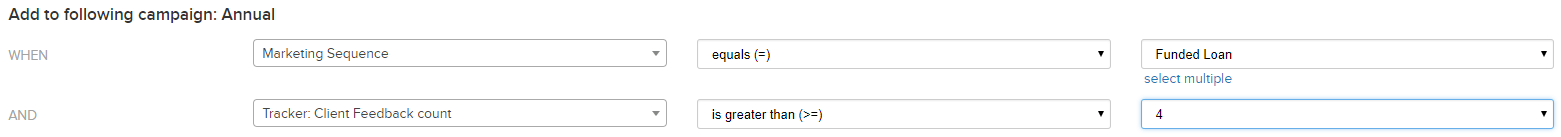

Feedback Trigger

Want to get the most feedback possible from a new article, piece of content or offering? Send out a survey using a Tracker Trigger to your past borrowers that have responded to 4 or more of your surveys in the past. -

Congratulate Partners

Want to automatically send out a congratulatory text message thanking one of your partners for referring you 10 clients? Create a Tracker Trigger that adds your partners to a thank you campaign once they’ve logged 10 referrals in the tracker.

Key Takeaways

- Automated Alerts for Key Milestones

The Mortgage Tracker tool offers automated alerts for various milestones in the loan process, such as application submission, document collection, and approval stages. These alerts help mortgage professionals stay on top of key events and reduce manual tracking.

- Improved Client Communication

With triggers set up in the system, mortgage professionals can automatically send notifications to clients when certain milestones are reached, such as when their loan is approved or when documents are due. This keeps clients informed and engaged without manual follow-up.

- Enhanced Efficiency and Workflow Management

By using the tracker and its triggers, mortgage professionals can focus on high-priority tasks while the system handles repetitive notifications. This leads to a more efficient workflow and ensures important deadlines and actions are never missed.

Commonly Asked Questions

- How does the Mortgage Tracker improve client communication?

The tracker sends automatic notifications to clients at key milestones, keeping them informed throughout the loan process without requiring manual follow-up from the mortgage professional.

- What are triggers in the Mortgage Tracker tool?

Triggers are automated alerts that notify mortgage professionals when certain events or milestones occur in a loan’s lifecycle, such as when a loan application is submitted or when documents are ready.

- How does the Mortgage Tracker help with efficiency?

By automating the tracking and notification process, the Mortgage Tracker tool allows mortgage professionals to focus on high-priority tasks, enhancing workflow and reducing manual intervention.

- What types of milestones can be tracked with the Mortgage Tracker?

Milestones include loan submission, document collection, approval stages, and other critical points in the loan process that require attention or communication with clients.