Summary

This article explores strategies for leveraging a Mortgage CRM to enhance client relationships and generate repeat business. Learn about the importance of personalized communication, efficient follow-ups, and tracking client interactions to build trust and encourage referrals. By the end, you’ll understand how to utilize CRM tools to foster long-term client loyalty and expand your mortgage business.

Mortgage leads hold the key to growing your business. However, adding prospects to your pipeline only marks the first stage in the lending journey. If you want to turn leads into clients, you need to master the art of conversion. Here are some mortgage lead conversions best practices to help you earn more business.

The Importance of Efficient Mortgage Lead Conversion

Mortgage lead conversions cost time and money. If you aren’t converting prospects, you are throwing money down the drain. This holds true no matter how you are sourcing potential clients.

Building out your own lead funnel involves creating a great website and publishing quality content. Both of those tasks distract from your core responsibilities. If you are consistently converting those leads, you can justify the time commitment. If not, your business won’t grow.

Communication Strategies to Enhance Conversion Rates

Mortgage lead conversion comes down to communication. You are already great at talking clients through the lending process. Now, you need to apply those skills to lead gen.

Focus on delivering value to your audience first and asking for business second. Apply this concept to all of your marketing content, including blogs, emails, and direct messages. You need to showcase your expertise and educate audiences. After you do that, many prospects will be eager to work with you.

So where should you connect with prospects? Don’t rely on just one channel. Use a multifaceted approach. Consider mediums like:

- Text

- Social media

- Paid ads

- Your website

These channels are interconnected. Treat them as such. Use the same tone throughout and steadily nurture prospects through the conversion funnel.

Most importantly, choose the right messaging frequency. Don’t blow up a prospect’s inbox with a dozen emails in the first week. Choose a frequency that keeps your business top of mind without overwhelming your audience.

Mastering frequency, tone, and delivery methods will go a long way in maximizing your conversion rate.

How CRM Features Aid in Conversion

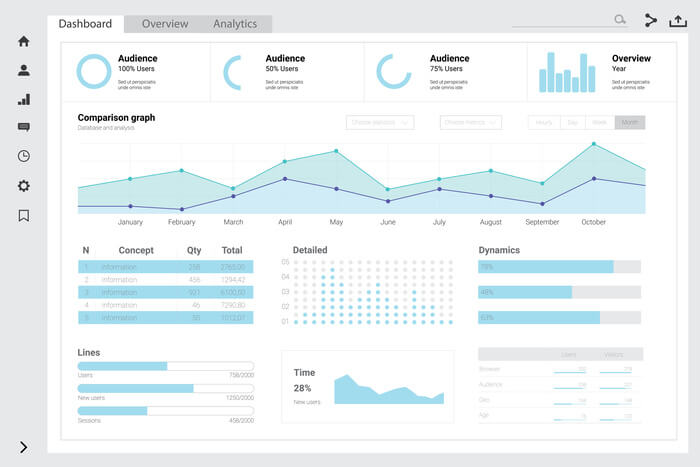

The best lead mortgage tools allow you to create custom campaigns to nurture prospects. Customer relationship management (CRM) solutions like BNTouch provide a one-stop shop for tracking leads and building relationships with your clients.

A CRM assists with all phases of mortgage lead nurturing. You can capture leads with emails or social media forms. From there, you can build relationships using personalized communications. You’ll also be able to follow up with past clients in your CRM. Staying connected opens the door for repeat business.

Nurturing Leads to Improve Conversion Rates

Lead nurturing involves developing and maintaining relationships with customers over time. You’ll do this by delivering marketing content using a CRM and other tools, such as your social media pages.

Some relationships develop fast. Others require months of hard work. Either way, it’s important to consistently deliver value to your audience. Don’t stop nurturing a lead once you’ve won them over.

Analyzing Conversion Metrics for Strategic Improvements

Conversion rate data helps you identify if your mortgage lead nurturing strategies are working. There are many different data points to consider, but the big three are:

- Cost Per Conversion (CPC): The average you spend to acquire a new client

- Lead Conversion Rate: The percentage of prospects that turn into customers

- Revenue: How much income you generate

Use these and other metrics to understand the customer journey and get better at driving conversion.

Win More Clients With BNTouch

BNTouch is a robust CRM that helps with lead acquisition and nurturing. Schedule a demo and let us help you build your mortgage business.

Key Takeaways

- Personalized Communication Enhances Client Relationships

Utilizing a CRM allows for tailored interactions, making clients feel valued and understood.

- Efficient Follow-Ups Increase Repeat Business

Automated reminders and follow-up sequences ensure timely communication, keeping you top-of-mind for clients.

- Tracking Interactions Builds Trust

Documenting client preferences and history enables more meaningful engagements, fostering trust and encouraging referrals.

Commonly Asked Questions

- How can personalized communication impact client relationships?

Tailored interactions through a CRM make clients feel valued, enhancing relationships.

- What role do efficient follow-ups play in generating repeat business?

Timely follow-ups keep you top-of-mind, increasing the likelihood of repeat business.

- Why is tracking client interactions important?

It enables more meaningful engagements, building trust and encouraging referrals.

- How does a Mortgage CRM contribute to business growth?

By enhancing client relationships and streamlining communication, leading to increased referrals and repeat business.