Summary

The blog post explores how mortgage CRM data analysis can help brokers and loan officers streamline operations, enhance customer engagement, and make data-driven decisions. It emphasizes using CRM insights to identify trends, improve marketing campaigns, and better manage pipelines. By leveraging analytics, mortgage professionals can strengthen client relationships and boost efficiency.

Year-End Marketing Ideas for Mortgage Professionals Using CRM Data Analysis

As the year comes to a close, it’s the perfect time to leverage all of that data in your customer relationship management (CRM) platform. Mortgage CRM data analysis can provide actionable customer insights that you can use to create targeted campaigns and personalized offers.

Here are some creative year-end marketing ideas powered by CRM data analysis to help you finish strong.

What Is CRM Data Analysis?

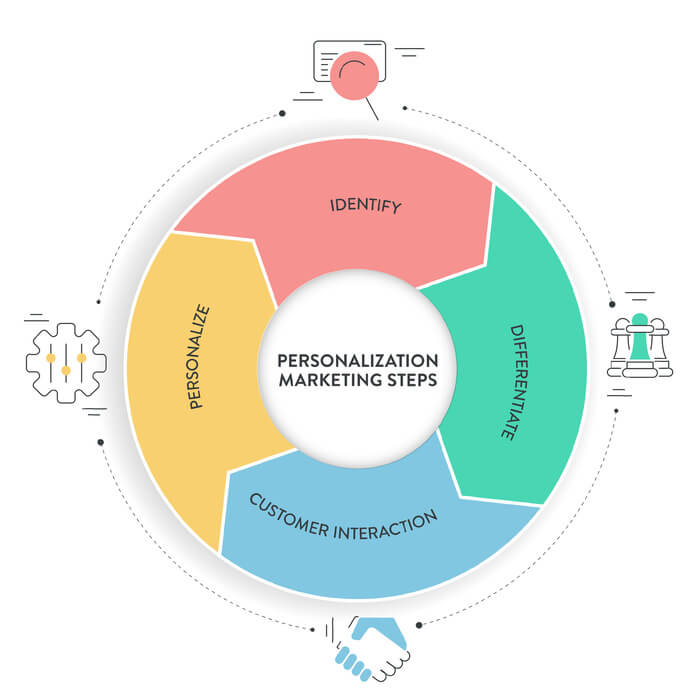

CRM data analysis is the process of looking at the information in your customer relationship management system. The goal of CRM data analysis is to better understand each audience segment (i.e., past clients, prospects, refinancing clients).

Through CRM data analysis, you can learn more about:

- Market trends

- Client behavior

- Campaign performance

- How to adapt to future market conditions

The bottom line is that analytics tools allow you to be a better mortgage professional and close more deals. Sounds like a clear win-win!

How to Use CRM Data Analysis to Finish Strong

Here are three ways you can use CRM data analysis to create winning campaigns and end 2024 on a high note:

Use Analytics to Create Personalized Offers

One of the most powerful ways to use CRM data is by tailoring your offers to your clients’ needs. Figure out what people need and showcase a product that aligns with those goals. For example, you could target homeowners with refinancing incentives. You could also market first-time buyer programs to individuals looking to buy their first homes.

Personalized offers tell clients that you are listening to them. They don’t want to be presented with a bunch of irrelevant offers. They are more interested in programs that will bring their vision to reality.

Build Targeted Campaigns Using Templates

Creating impactful year-end campaigns doesn’t have to mean starting from scratch. You’ve learned a lot about your audience over the past year. Use all of that info by customizing pre-built templates within your CRM.

Pre-built templates can create better email, SMS, and social media campaigns. Create custom content for each audience, and establish yourself as a source of reliable information. These ready-made tools save time and ensure your messaging is professional and engaging.

Explore Trends to Plan Ahead

The end of 2024 is the perfect time to reflect on what worked well throughout the year. Use CRM data analysis to learn more about what you did right and how you can get better.

Identify your most successful campaigns and which segments engaged most with your content. Make these strategies and audiences a priority in 2025 to start the new year off strong.

You should also take a deep dive into what you can do better. Be honest with yourself, and learn from past mistakes to become more well-rounded.

Leverage CRM Data Analysis With BNTouch

You can’t perform CRM data analysis without the right customer relationships management platform. That’s where BNTouch can help.

Our dynamic solution has robust CRM data analysis tools that let you slice and dice client information on your terms. Run custom reports and better understand how to serve and connect with your clients.

Ready to take the guesswork out of mortgage marketing? Demo BNTouch today!

Key Takeaways

- Marketing Strategies:

The blog emphasizes the importance of targeted marketing and how specific techniques can attract potential clients for mortgage businesses.

- Client Acquisition:

It discusses effective client acquisition methods such as leveraging social media, networking, and referral partnerships to drive business.

- Efficiency Boosters:

Tools and CRM systems are highlighted as crucial for enhancing productivity and streamlining operations in mortgage businesses.

Commonly Asked Questions

- How can a strategic mortgage broker business plan improve lead generation and drive growth?

A strategic mortgage broker business plan helps set clear goals, streamline operations, and attract quality leads. It focuses on targeted marketing efforts, building strong referral networks, and fostering customer loyalty, all while aligning with market trends.

- What are effective marketing strategies for loan officers to attract more clients?

Marketing strategies for loan officers include leveraging digital channels like social media ads, building strong referral networks, and consistently engaging clients with valuable content. Additionally, providing excellent customer service and maintaining regular follow-ups can help strengthen relationships, build trust, and generate more referrals.

- What are the most effective client acquisition techniques for loan officers?

Client acquisition techniques for loan officers include building strong referral networks, leveraging digital marketing platforms such as social media, and using targeted email campaigns. Engaging potential clients with helpful content, maintaining personalized communication, and providing excellent customer service can also significantly boost client acquisition.