Summary

This article focuses on the importance of maximizing the usage of your mortgage CRM account to boost productivity, enhance lead management, and improve client relationships. Learn about the key features of a mortgage CRM that can streamline your business and how you can leverage them to drive success. By the end, you’ll understand how to fully utilize your CRM to achieve better results.

When you and your team are using all of the tools available in your CRM’s tool belt your business will grow as a result. It’s very important to us that everyone is getting the most out of our system and that is why we’ve put together this new tool that will break down the mortgage CRM account usage of everyone on your team.

This new account usage tool breaks down all the important aspect of the platform and shows how much each member of your team is using them. This will offer an overview of account activity and ensure that you’ll be able to provide training, resources and support to anyone on your team who seems to be struggling in a specific area of the CRM.

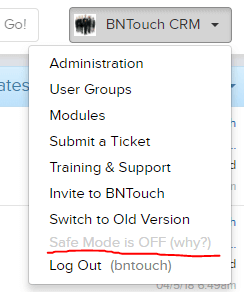

You’re Account Usage section will look similar to the example above and can be found under here, or “Administration” then “Usage” in your account.

Pro Tips:

Not all sections are created equally, here are a few pro-tip takeaways you can utilize from your account activity reports.

- App Section – Everyone on your team should be marked yes here. The BNTouch mobile app allows users to run the important CRM features from their phones. With click to call reminders, calendar/task access and live statistics any time this is an important feature for your whole team to be using. If anyone on your team is checked “No” here we recommend you reach out and get them trained and comfortable with the mobile app. The app can be found in the App or Google Play store by searching “BNTouch”.

Safe Mode – Another important column, if safe mode is on then any automated emails or marketing will not work for that account. Safe mode is for when you are training new teammates and do not want them accidentally sending things out. Once someone is up and running you want to make sure that safe mode is off and that they’re getting the full power of the CRM.

Safe Mode – Another important column, if safe mode is on then any automated emails or marketing will not work for that account. Safe mode is for when you are training new teammates and do not want them accidentally sending things out. Once someone is up and running you want to make sure that safe mode is off and that they’re getting the full power of the CRM.- Running Campaigns Section – This will show you how much active marketing anyone on your team is doing. The more running campaigns they have going the more active marketing that’s going on. If an account has low or no running campaigns that can indicate they need more training in the automation features of the system. Try showing them the Content Exchange or activating the Marketing Control Center so they can start adding pre-made campaigns to their account and increase their running campaigns number with ease.

- Portal Apps – This gives you the number of borrowers associated with that account who have downloaded the Mortgage Circles app. This is also an important statistic because the more of your teams borrowers that have downloaded mortgage circles and can access the benefits of portals from anywhere, the better communication will be between you and your borrowers. If someone on your team has a lower number here than everyone else it can signal that they don’t understand the benefits of using portals and the mortgage circles app and may be time for some extra training.

Section Glossary:

User ID: The unique identification number associated with each account

Name: The name associated with each account

Username: The username used to login to each account

Created: The date each account was created

Last Login: The last time each account has logged into BNTouch

App: Whether that account has downloaded and logged into the mobile app

Last Sync: The last time that each account has synced with outside L.O.S.

Safe Mode: Informs you if an account is in safe mode or not (If an account is in safe mode it will not be able to automatically send emails and campaign steps)

Campaigns: This is the amount of marketing campaigns created by or associated with each account

Running Campaigns: The amount of unique campaign instances associated with each account (for example if you have a birthday campaign running for one borrower, that is one instance)

Steps Sent: This is the total number of campaign steps (or marketing pieces) sent from each account

Mortgages: The amount of mortgage records associated with each account

Partnerships: The amount of partner records associated with each account

Recruiting: The amount of recruiting records associated with each account

Portal Visits: The total number of visits received to all portals created from each account

Portal Apps: The total number of clients who have downloaded and accessed their portal using the Mortgage Circles App.

Activity Score: The overall score based on averaging all of the previous columns, this number represents the big picture Activity of each account

Key Takeaways

- Maximize Client Management

A mortgage CRM helps you centralize all client data, enabling easier tracking, communication, and follow-ups. By using these features, mortgage professionals can build stronger relationships with clients and offer a more personalized experience.

- Efficient Lead Tracking and Conversion

With a CRM, lead tracking becomes a streamlined process. The article emphasizes how mortgage professionals can automate lead nurturing, ensuring that leads are followed up promptly and increasing conversion rates.

- Boost Sales and Repeat Business

The CRM not only helps convert new leads but also retains existing clients. By using the CRM’s features to track past clients and send reminders for refinancing, mortgage professionals can keep a steady stream of business through repeat clients.

Commonly Asked Questions

- How does a mortgage CRM improve client management?

A mortgage CRM centralizes client data, enabling mortgage professionals to track communication, set follow-up reminders, and offer personalized services more easily.

- What role does lead tracking play in the mortgage CRM?

The mortgage CRM automates lead tracking, helping professionals stay on top of new leads, follow up effectively, and increase the chances of conversion.

- How can a mortgage CRM help generate repeat business?

A CRM tracks client history and can send reminders for refinancing or other services, encouraging repeat business and keeping relationships active.

- Why is it important to maximize the use of a mortgage CRM?

Maximizing the use of a mortgage CRM boosts productivity, improves client relations, and helps mortgage professionals convert more leads into long-term clients.