In today’s digital-first world, people rarely walk into a mortgage office anymore. In-person meetings are still part of the lending process. However, most of your clients will find you online. That’s where mortgage content comes in. The right mortgage content strategy helps you connect with borrowers and build trust. You can showcase your experience and make leads feel confident in your knowledge.

The best mortgage content can ease the apprehension of buying a home for the first time. It makes the process feel exciting and manageable, not intimidating.

In this guide, we’ll walk you through what a mortgage content strategy is. We’ll also dive into how to create a mortgage content funnel that builds trust and authority.

What Is a Mortgage Content Strategy?

A mortgage content strategy is your game plan for creating and sharing helpful information. Most of your content won’t be promotional. Instead, a mortgage content strategy focuses on:

- Answering questions

- Solving problems

- Providing insights

- Earning trust

Before you start publishing mortgage content, you need to put together a detailed strategy. Your strategy should cover the following:

- Who your audience is

- What information they need at each stage

- Where you’ll share your content

- When and how often you’ll post content

Next, you’ll need to come up with mortgage content ideas. Great mortgage content is the foundation of a winning strategy. Make sure your content is on-brand and aligned with the needs of your target audience.

Let’s take a closer look at the marketing funnel so you can design content for each stage.

How Do I Create a Mortgage Content Funnel?

A mortgage content funnel maps out the journey borrowers take. It begins when people learn about mortgages and your business. This is the widest part of the funnel. The end is when they close a loan with you.

The customer journey is described using a funnel because most people who enter never make it to the final stage. That’s okay — your goal is to fill your funnel and win as many clients as possible. Losing some along the way is to be expected.

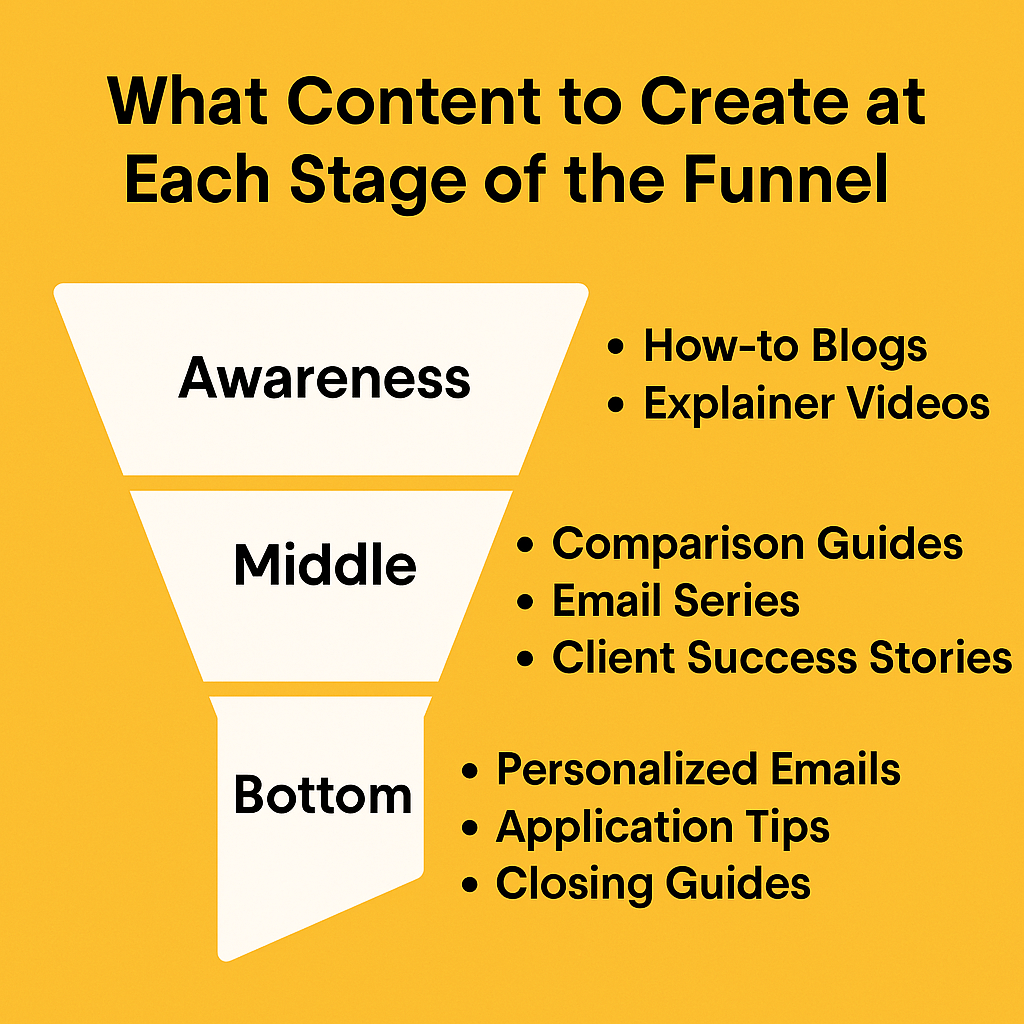

What happens between someone finding out about mortgages and closing a deal? Here’s a simple way to break down the stages of the mortgage marketing funnel.

Top of the Funnel: Awareness

At this stage, borrowers are just starting their research. They’re not ready to apply yet. They just want answers to big questions like:

- How does getting a mortgage work?

- How much home can I afford?

- Is it a good time to buy?

Keep in mind that different audiences will have different questions. For example, homeowners who want to refinance will be more focused on current rates during the awareness stage. They probably know how mortgages work and don’t want content on that topic. That’s why knowing your audience is so important.

The awareness stage is your chance to introduce yourself. You can start building trust with email, social content, and blogs.

Middle of the Funnel: Consideration

Borrowers in the middle of the funnel are more serious. They may be comparing lenders or looking at specific loan options. Mortgage content for this stage may include:

- Comparison guides

- An email series explaining loan programs

- Client success stories

- Live Q&As

The key is to have a tool that helps you track engagement during this stage. That way, you know if your content is having the intended effect.

BNTouch includes tools for tracking the performance of emails and links. These insights can help you build better mortgage content.

Bottom of the Funnel: Decision

The borrower at the bottom of the funnel is almost ready to move forward. You just need to give them that final nudge. Your mortgage content should make them feel confident. Here are some of the content types you can use here:

- Personalized emails with checklists

- Application tips

- Easy guides on closing

- Secure forms to start the application

You can be direct during this stage — just don’t come off as pushy. Focus on maintaining that helpful, friendly tone.

What Kind of Content Works Best for Each Stage?

Social media and blogs should be staples of your mortgage content strategy. Four out of five internet users interact with both of these content mediums. The key is to adjust your messaging based on a person’s needs and pain points at each stage.

For example, leads in the awareness stage would benefit most from explainer videos and how-to blogs. Individuals in the consideration stage will be responsive to ongoing nurturing and deeper content. In the final stage, target your audience with applications or personalized follow-ups.

Each borrower will move through the funnel at their own speed. Don’t give up on slow movers. Some people may not be eligible for a mortgage yet. Stay with them and be genuinely helpful to earn their trust.

How Do I Map My Content to Different Borrower Types?

Not all borrowers are the same. A first-time homebuyer will have different questions from a refinancer. If you want your mortgage content to resonate, you need to personalize it.

A first-time buyer needs help learning the basics. They’re worried about their credit score and down payment requirements. As a result, they can benefit from encouraging content like:

- Beginner-friendly blog series

- Fun infographics

- Explainer videos on social media

Refinancers have an entirely different set of needs. Their goals include saving money or cashing out. They know how mortgages work and want fast answers. With that in mind, you can create targeted mortgage content, such as:

- Comparison calculators

- A breakdown of potential savings

- An “Is it time to refinance?” checklist

These are just a few examples of leads you may be targeting. Think about who your audience is and what pain points they’re facing.

How Can I Use Automation to Send the Right Content at the Right Time?

Automated content for mortgage brokers helps you send the right message at the ideal stage of the borrower journey. Here are some ways to use automation to perfect the timing of your messaging:

Set Custom Triggers

A trigger is an event that prompts a predefined, automated marketing response. Let’s say a new lead visits your website and fills out a contact form. Filling out the form could trigger an automated email response.

Messaging the lead right away satisfies their desire for instant gratification. It also buys you time to follow up directly.

You can set custom triggers for just about anything. These triggers help you connect with leads when their interest is at its peak.

Create Drip Campaigns

A drip campaign is a series of emails that go out over time. Drip campaigns are great for nurturing leads and delivering helpful weekly content. For example, a “First-Time Buyer Starter Pack” could provide nuggets of information via a series of six weekly emails.

Use Tags and Smart Lists

A modern customer relationship management (CRM) platform can allow you to tag leads. These tags identify what type of client the lead is. Some examples include “Investor,” “Refinancer,” and “First-time buyer.”

Once you’ve tagged all of your leads, separate them into lists. BNTouch creates smart lists automatically based on lead tags. This feature helps you target each audience with content tailored for them.

Track Engagement

Engagement refers to any positive action someone takes with your content. Examples include opening emails or clicking on links. Engagement metrics reveal the impact and reach of your mortgage content.

Use engagement data to follow up with high-intent leads. You can also use these insights to identify which assets perform well and which ones need some fine-tuning. Not every piece of content you put out is going to be a home run. The goal is to figure out what your audience likes so you can make your content better.

Adjust and Improve

Automated content platforms also include analytics tools. You can use these capabilities to better understand your target audience’s needs and preferences. Over time, you can refine your mortgage content to close more deals and grow your business.

Why Mortgage Content Builds Trust and Authority

Sharing helpful, honest, reliable information shows borrowers you’re there to guide them. By contrast, salesy content can come off as pushy and obtrusive.

Leading with value and free educational resources builds trust. When your content is smart and easy to understand, it positions you as a mortgage expert. That’s what turns leads into loyal clients.

Final Tips to Optimize Your Mortgage Content Marketing Funnel

Ready to start creating mortgage content to fill your funnel? Here are a few tips to help you stand out from the competition:

- Post content regularly so borrowers see you as a reliable resource

- Write in an organic and natural way

- Educate first, sell second

- Use BNTouch templates and automation to scale your marketing campaign

Winning at mortgage content creation means having a rock-solid plan and the right tools. If you don’t have a CRM that supports your marketing efforts, it’s time for an upgrade.

Create Better Mortgage Marketing Content With BNTouch

BNTouch makes creating trustworthy and engaging content easier than ever. Our platform includes a huge library of customizable templates and robust reporting tools. You can access over 180 ready-made campaigns—including email sequences, videos, and co-branded content—to stay top of mind with leads and clients. BNTouch also automates essential touchpoints like birthday greetings, loan anniversaries, and refinance opportunity alerts. With dynamic content updates, personalized video messaging, and built-in social media insights, you’ll have everything you need to engage your audience at every stage of the mortgage funnel—all from one platform.

Build your marketing funnel and seize every opportunity with BNTouch. Request a live demo today!