Summary

This article explains the loan officer and lead reports and its significance of detailed lead reporting for loan officers to optimize performance. It discusses tracking lead sources, evaluating conversion rates, and identifying trends to refine strategies. The post emphasizes the role of data-driven insights in improving decision-making and resource allocation. By utilizing lead reports, loan officers can enhance their effectiveness and achieve better results.

Get access to 20 reports with BNTouch’s full analytics section. Track your leads, lead sources, funded loans, office performance, cancelled loans and so much more. Today we’re going to be walking you through each available reporting tool that’s available with BNTouch. All the information is available for you to hypothesize, test, see your results and make business decisions based on data.

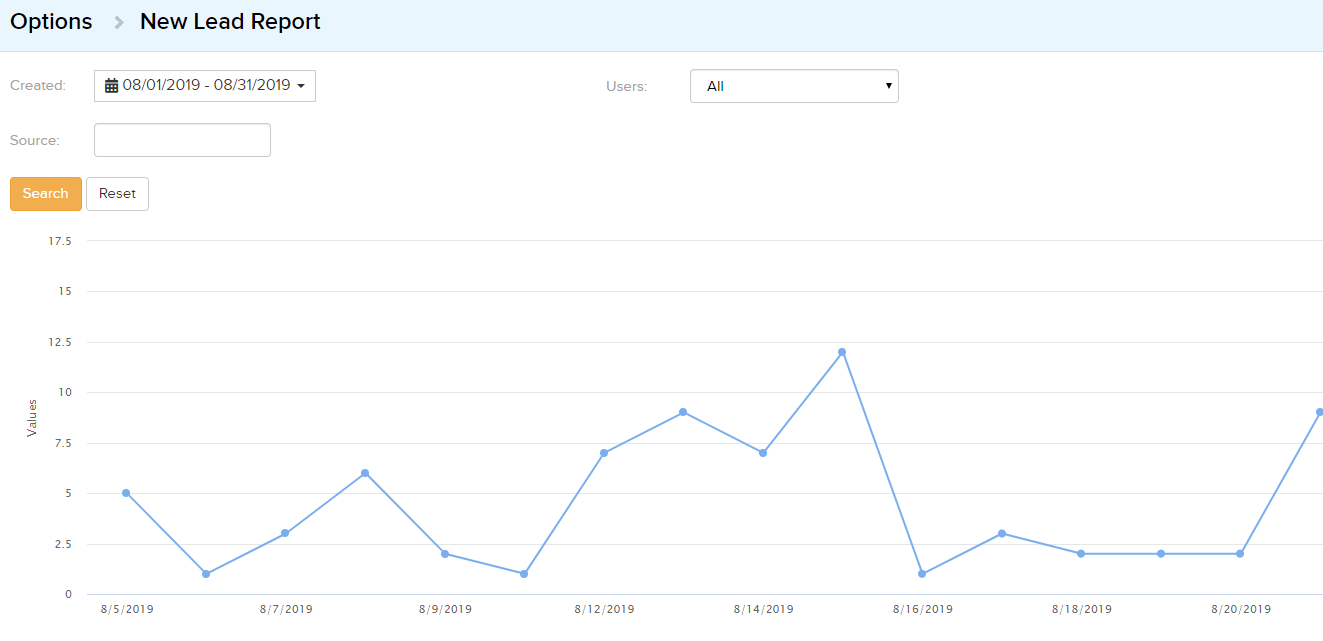

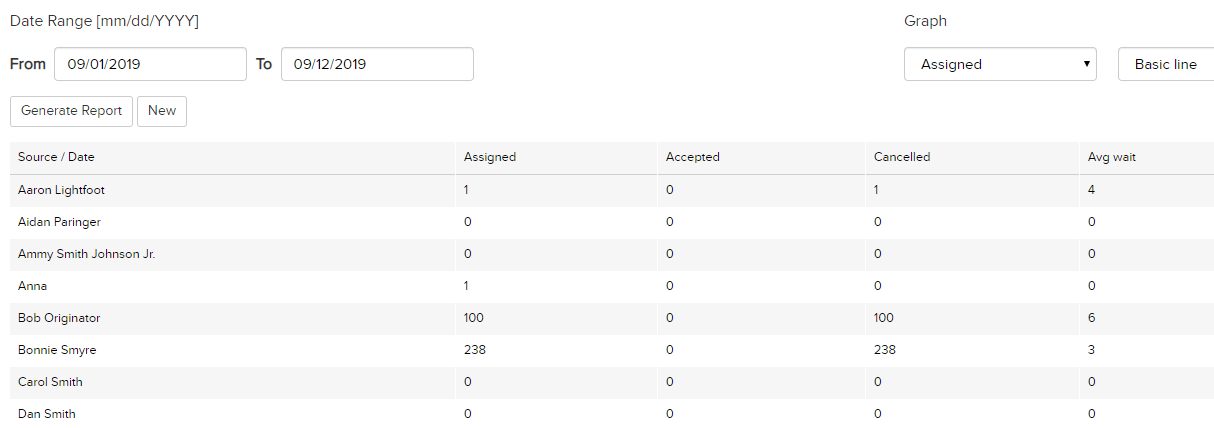

Update: 9/12/19 – New Loan Officer Lead Report

We’ve just added a brand new report that will breakdown all of your leads by any date range. Leads will be plotted on a graph and shown below in a list. All leads will be able to be clicked and contacted right from the report. Get real time feedback on your lead counts over any date range and see if your new marketing tactics are working or bringing down your lead count.

-

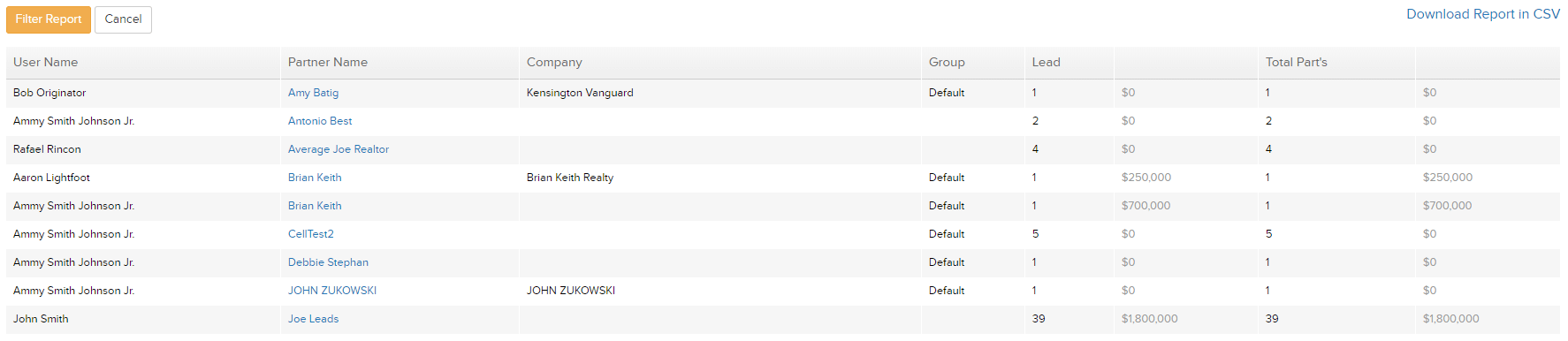

Participant Report

This report will show you participation statistics for your partners. It can be used to easily identify your best referral partners by tracking the value earned from each of their leads provided.

-

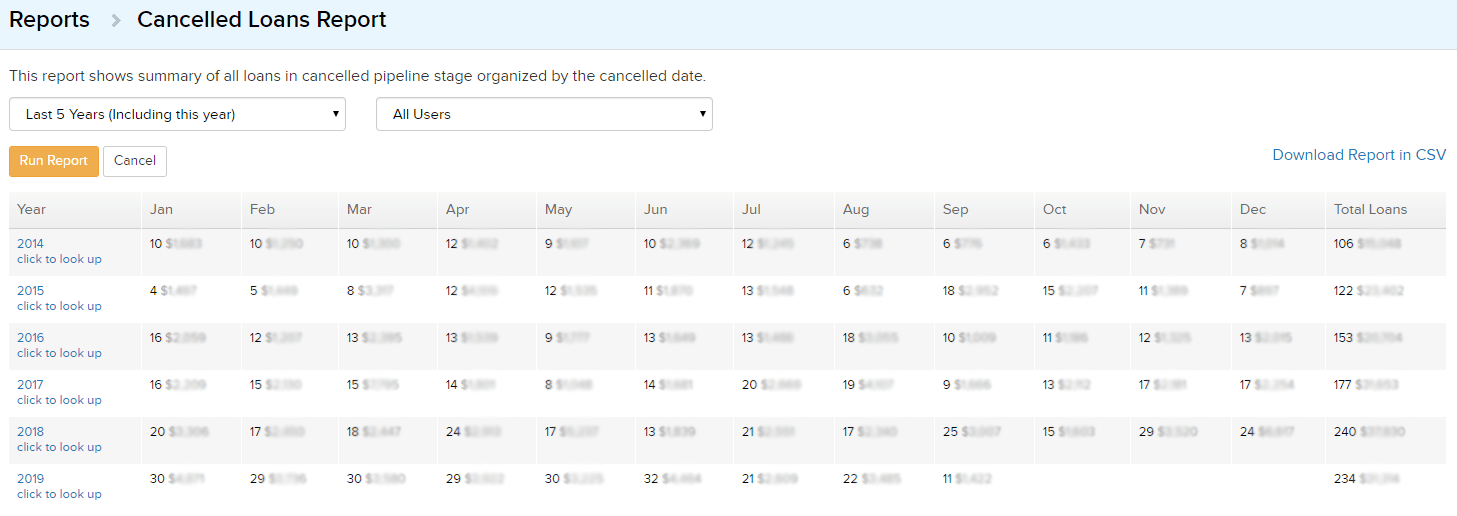

Cancelled Loans Report

This report will show you a summary of all loans that have been cancelled in your pipeline. They’ll be organized by date showing monthly and yearly comparisons. Track if your new marketing, funnels or campaigns are making a difference in your cancelled rate.

-

Extended Tracker Report

This report shows all activity in your account. For example: You’ll be able to view a list of all marketing pieces that went out or all phone calls that you logged into the CRM.

-

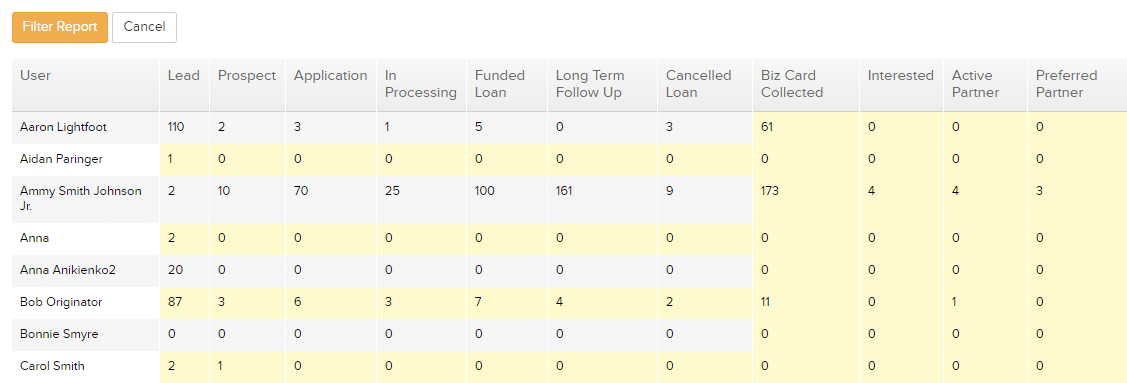

Database Summary Report

This report will show you an overview of all loans and partnerships in your pipeline divided by stages.

-

Marketing Campaigns Activity

This report will breakdown how many marketing pieces were sent out within a selected date range.

-

Office Performance Report

This report will break down how many leads have been assigned to each person in your office and how active they are following up with those leads.

-

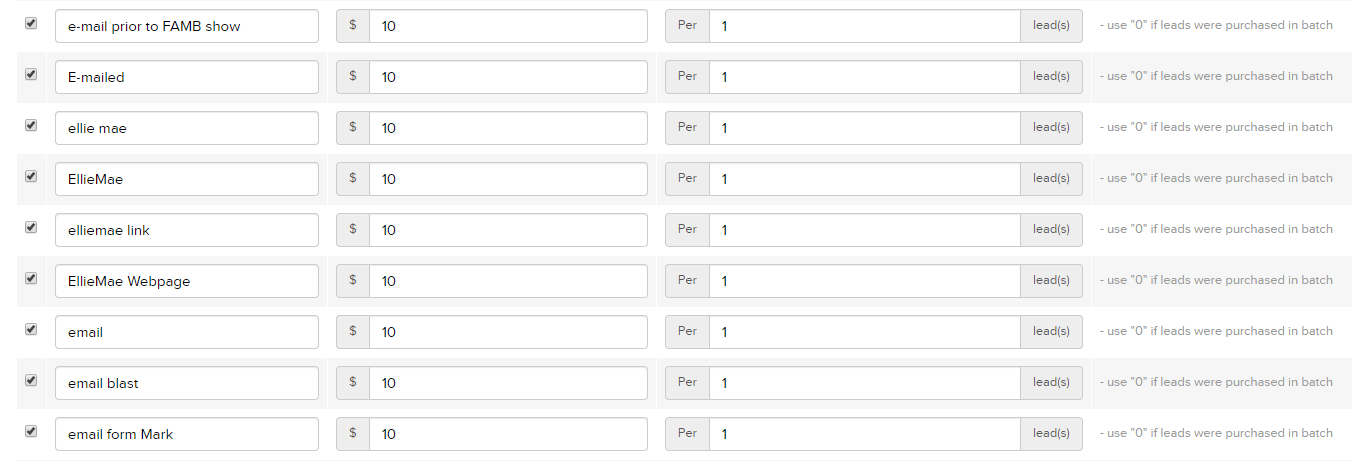

Return On Investment Report

This report will show you an estimated return on investment four any of your lead sources based on entered profit per lead data.

-

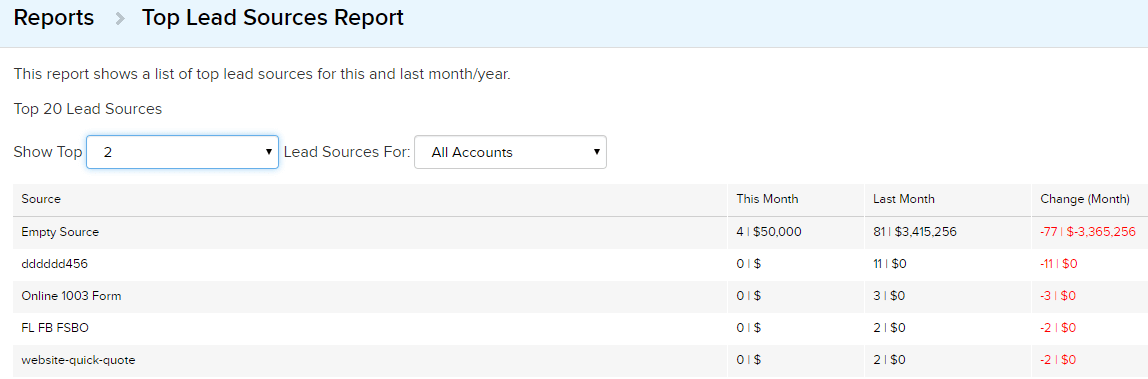

Top Lead Sources Report

This report shows a list of top lead sources for this and last month/year.

-

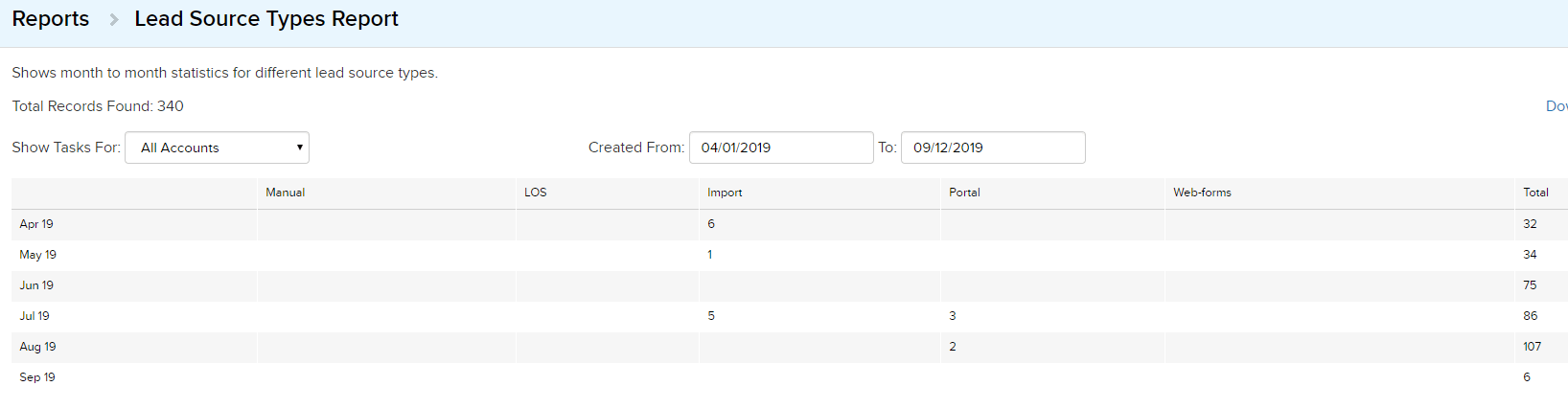

Lead Source Types Report

This report breaks down your month to month and year to year lead counts. Perfect for comparing your current lead counts to past periods.

-

Funded Loans Report

This report shows an overview of all the loans you have funded segmented by month and year. Track if your new marketing, funnels or campaigns are making a difference in your funded rate.

-

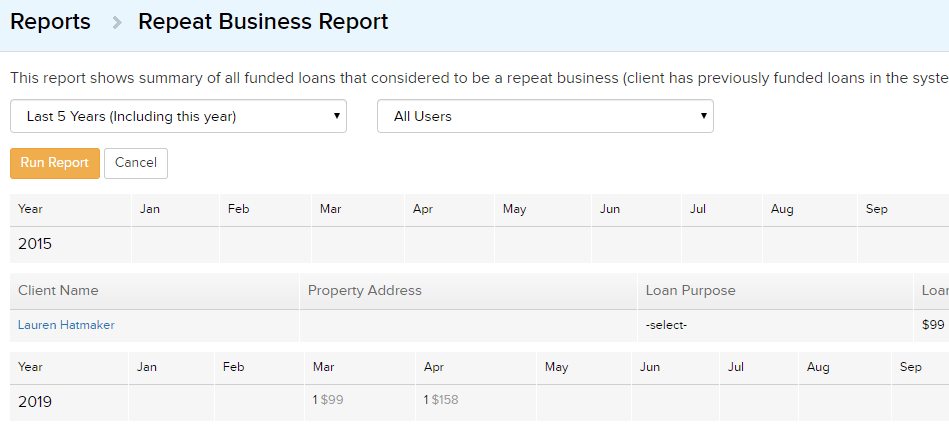

Repeat Business Report

This report shows a summary of all funded loans that are considered to be a repeat business.

-

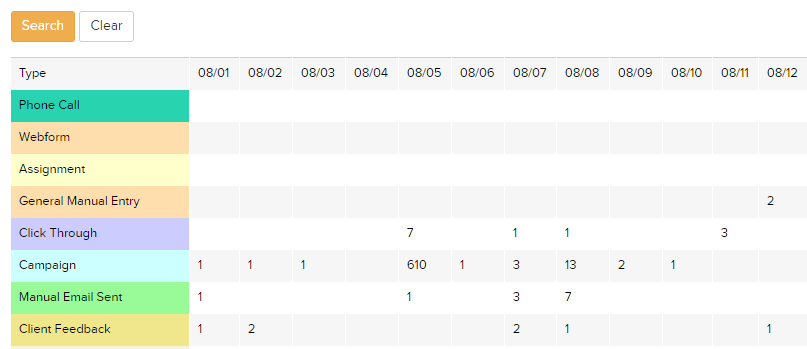

Tracker Summary Report

This report will show all of your CRM activity over a selected period of time.

-

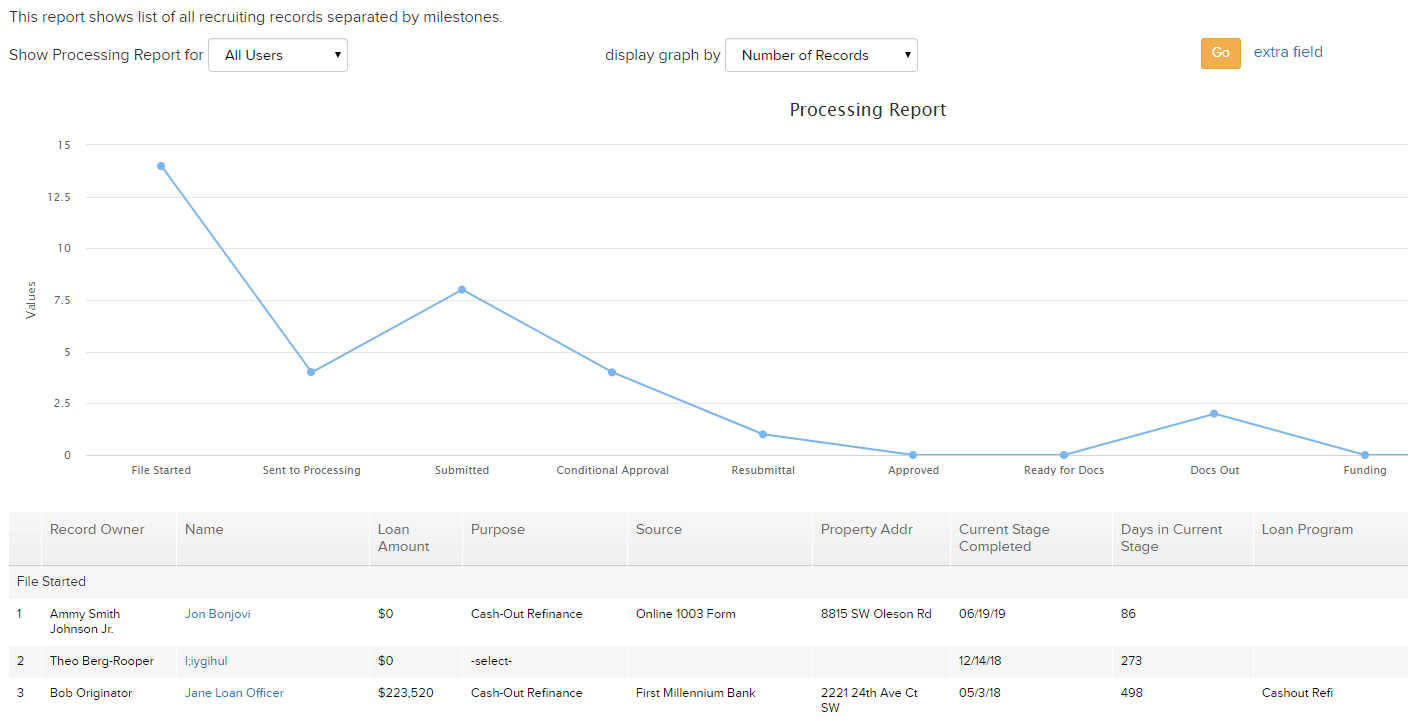

Extended Processing Report

This report will breakdown all of your recruiting contacts in your CRM by milestones. BNTouch has a full recruiting section to help you bring in the best talent and on-board those new recruits.

-

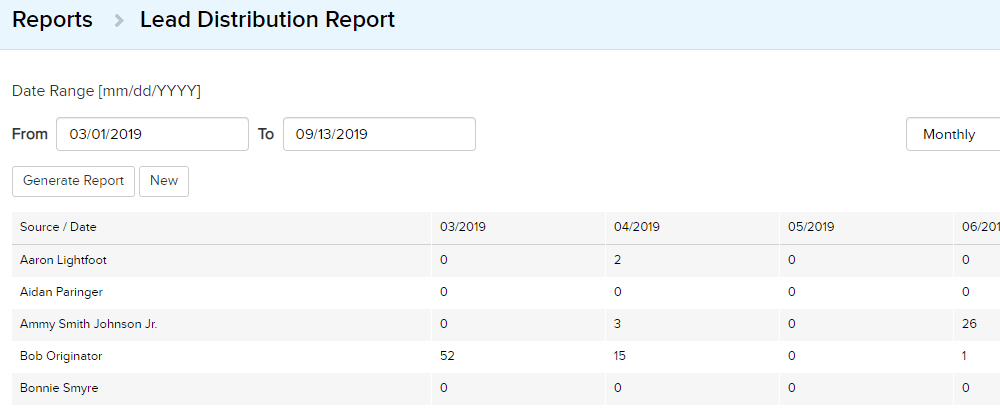

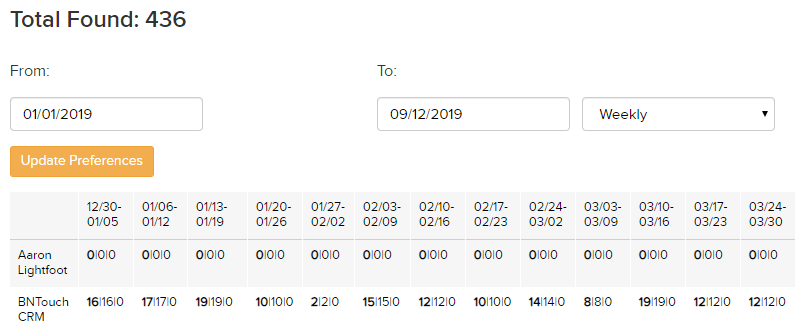

Lead Distribution Report

This report will show you how many leads are being assigned to each person within your office. Data can be broken down weekly, monthly or yearly.

-

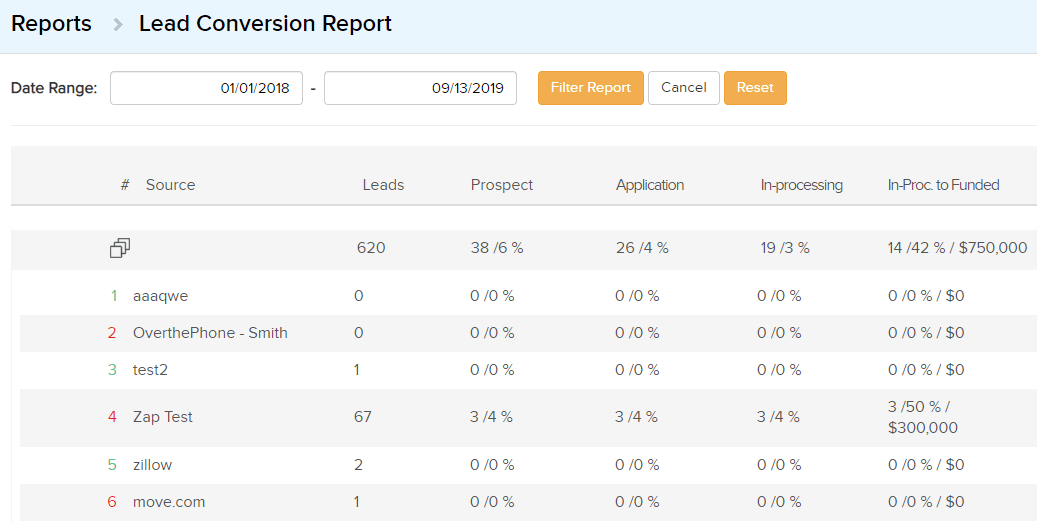

Lead Conversion Report

This report shows how many leads have been received by each lead source and how effective each loan officer has been at converting those leads.

-

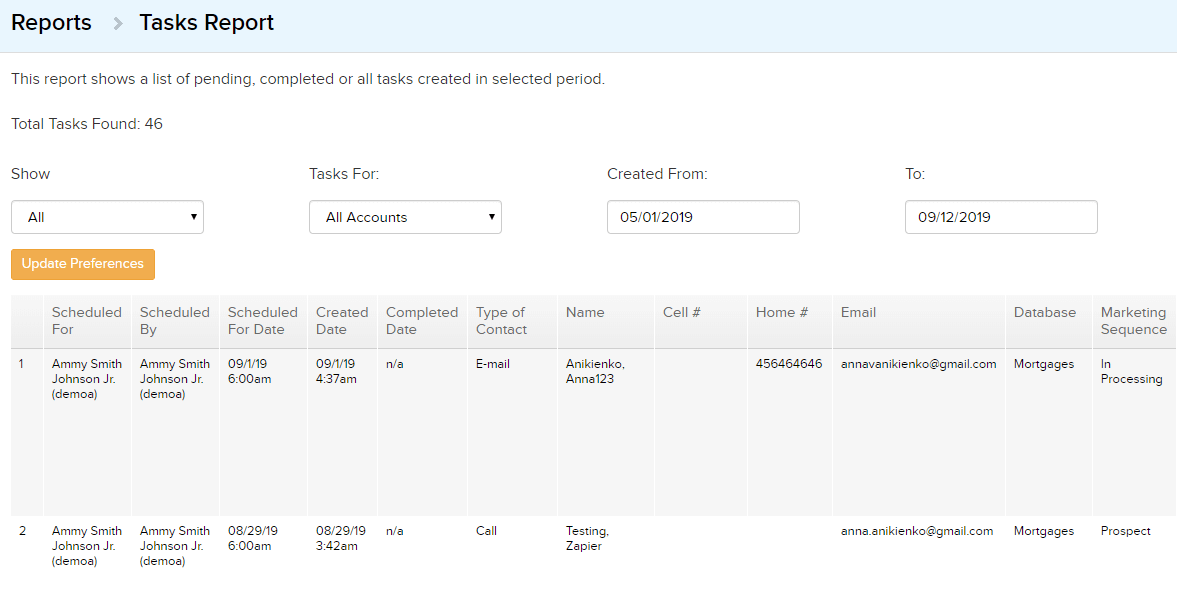

Tasks Report

Shows the pending and completed tasks you’ve added to your tasks lists over any selected date range.

-

Email Opt-Out & Bounce Report

This report will show you an overview of how many people opted-out of your email list for any date range separated by week or month.

-

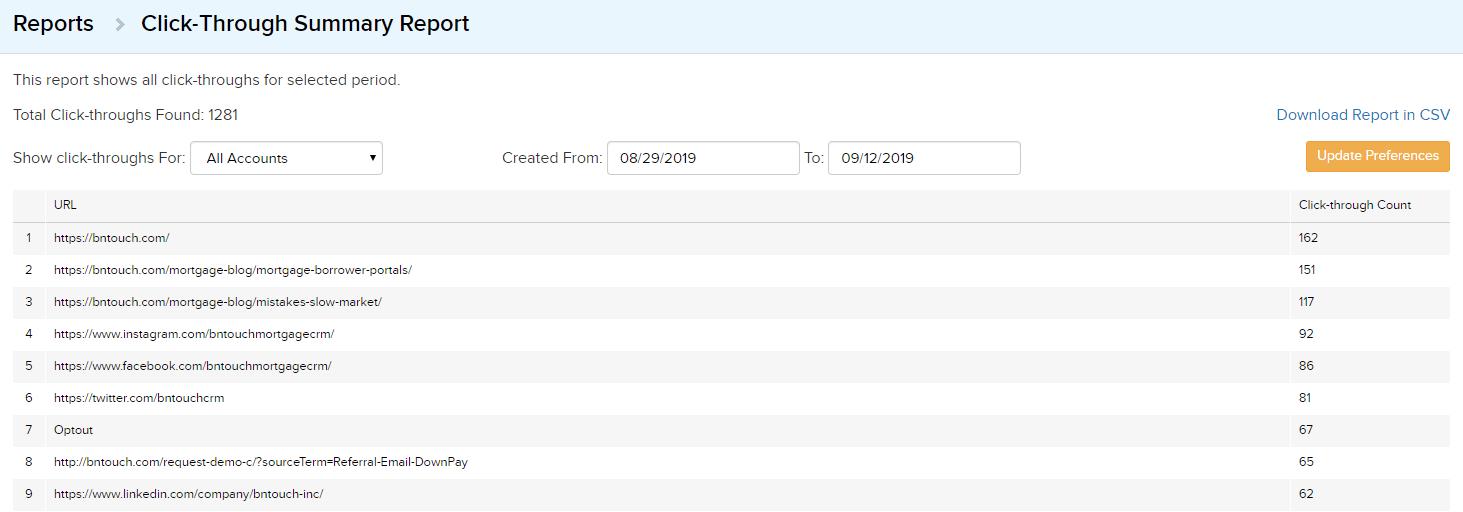

Click-Through Summary Report

This report will show you statistics on who clicked on the links in your marketing emails for any selected period.

Key Takeaway

- Track lead sources to focus on top performers.

Reports help identify the most productive lead channels.

- Analyze conversion rates for improvement.

Understanding lead-to-client ratios reveals where efforts need adjustment.

- Refine follow-up strategies with actionable insights.

Data from reports guides more effective communication tactics.

Commonly Asked Questions

- Why are lead reports critical for loan officers?

Lead reports provide a clear overview of progress, helping officers track conversions and identify high-potential opportunities.

- What data should lead reports include?

Reports should include lead sources, engagement history, conversion rates, and follow-up actions for effective decision-making.

- How do lead reports enhance productivity?

By highlighting priorities and areas needing attention, they help officers focus efforts and optimize their workflow.

- What tools make generating lead reports easier?

CRM software and analytics platforms automate report generation, saving time and ensuring accuracy.