Summary

This article covers LinkedIn Ads for Loan Officers. Learn about the key features of LinkedIn advertising, how to target your ideal audience, and the benefits of using LinkedIn Ads for mortgage lead generation. By the end, you’ll know how to effectively create and manage LinkedIn Ads campaigns to attract more qualified mortgage leads and grow your business. Linkedin is an invaluable tool for mortgage brokers. While most people focus on LinkedIn’s organic reach and benefits, few think of the fact that LinkedIn actually has a powerful ads platform. Today we want to share with you how these campaigns work and how you can create the perfect campaign for your brokerage.

The Basics

Similar to Instagram or Facebook, running an ad campaign on LinkedIn involves two steps. First, you want to set up your campaign and then you want to create an ad. Let’s start by taking a look at how you can set up a campaign.

Step One: Setting Up Your Campaign

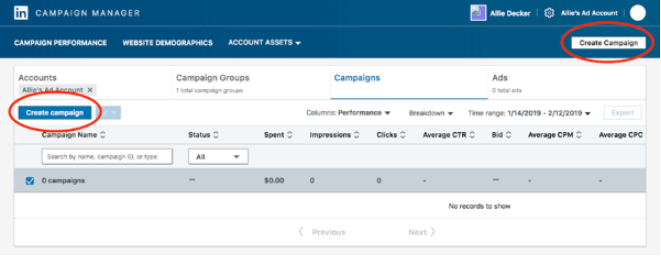

Similar to Facebook, your LinkedIn ad campaigns will not actually reside on LinkedIn. Instead, they use a separate platform called the LinkedIn Marketing Solutions platform. To start setting up your campaign simply click the “Create Ad” button.

If you haven’t been in the campaign manager before, the system will prompt you to set up a Campaign After that relatively short step your screen will take you to the dashboard. Unlike Facebook, LinkedIn actually requires that you enter your payment information before you will be able to navigate further into the platform to create campaigns or ads (Don’t worry though. Entering your payment information won’t trigger any charges to your account).

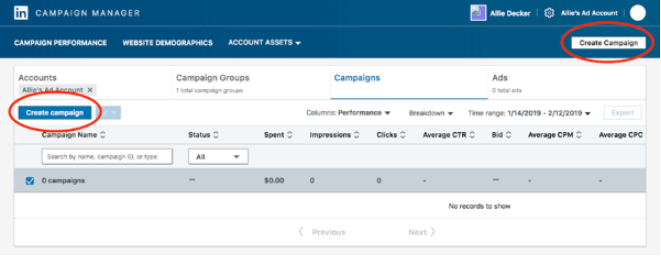

On the top right of the screen and on the left side of the window you’ll see buttons that say “Create campaign.” Click that button, and you’ll be redirected to a page where you can start setting up your campaign.

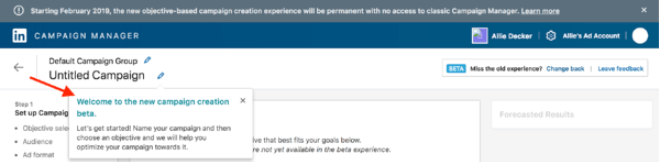

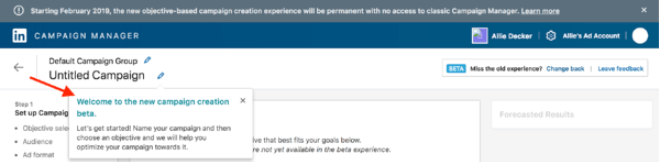

First, you’ll want to decide which Campaign Group you want your campaign stored in and then you want to give your campaign a name. Campaign Groups basically just help you organize your campaigns. For instance, maybe you are running separate ad campaigns for buyers and sellers. Or perhaps different loan programs. If you wanted to keep them separate, you would make a separate campaign grouping for each type.

The campaign name is for your own reference (it’s not public-facing), so we recommend you give it a very specific name that is very easy for you to glance at and know exactly what it is.

Once you’ve completed those two steps, you can begin setting up your campaign.

1. Select Your Objective

Every campaign has a purpose. What is it you want people who see your ad to do? This is referred to as your objective. Choosing an objective will trigger LinkedIn to customize your ad set up experience. They will customize your campaign creation, deliver the best ROI for your stated goal, and show you relevant reporting. This is great because it makes for a great time saver.

Here are descriptions of the available objectives you can choose from and some examples of times you would choose a particular objective:

Website visits (Awareness)- These ads will drive traffic to your website and landing pages. According to LinkedIn, this type of campaign will also boost brand awareness.

For instance, let’s say your brokerage has a new loan program and you want to get the word out about it as fast as possible. A website visits ad is the perfect vehicle for this because you can specifically craft an ad to drive traffic to the page on your brokerage website that explains all the loan program features and details.

Engagement (Consideration)- These ads will help you increase engagement on your content and boost followers on your LinkedIn Company Page.

A very common issue mortgage brokers face is actually getting traffic on their LinkedIn Company page. Engagement ads help you feature an article you’ve written, or your company page itself, showing it to your ideal prospective clients, making them aware of you and letting them learn more about the services you offer.

Video views (Consideration)- These ads are meant to increase the exposure of your videos to people who are likely to engage with them.

If you record and post lots of videos about the mortgage market conditions or past client testimonials, for instance, video views ads are a great way to get your video in front of your ideal clients that are most likely to engage with your video post.

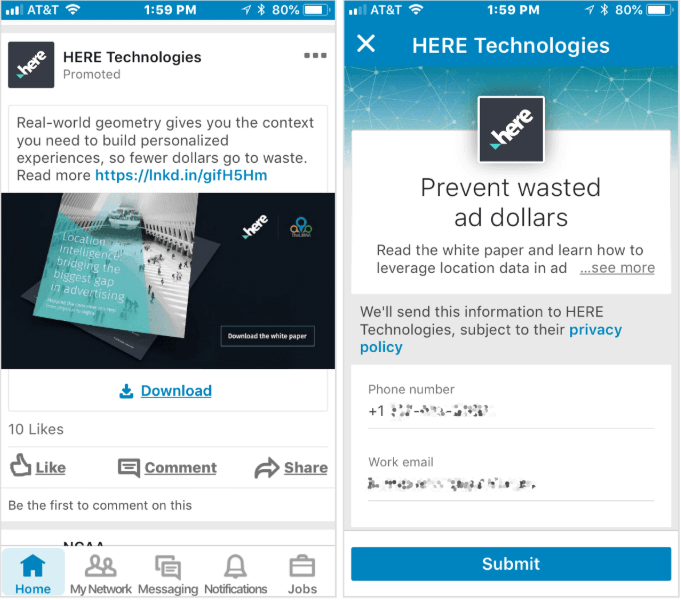

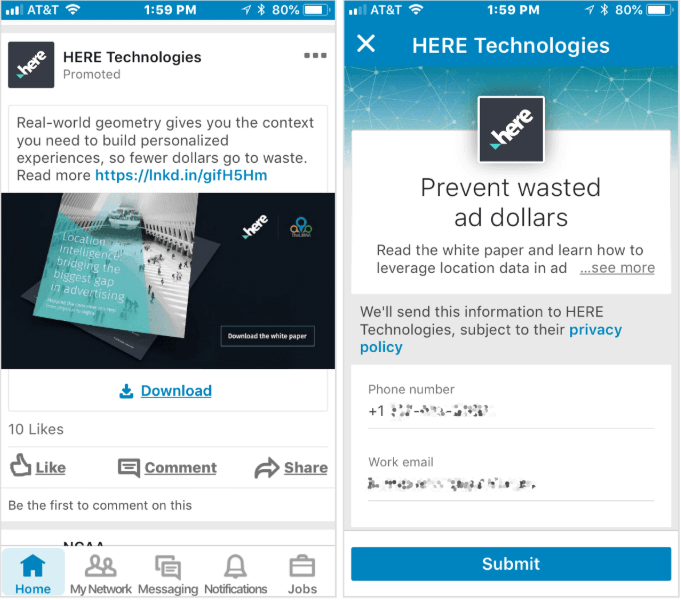

Lead generation (Conversion)- These ads will show a LinkedIn lead generation form with pre-filled your ideal prospect’s LinkedIn profile data to a subset of people in that group that are most likely to engage with the form.

For instance, if you were holding a real estate investment seminar or webinar, you could target high net worth individuals in your marketplace and send them an ad about the event. When they click the call to action button, a form (much like a Facebook lead form) will auto-populate all their details, making it very easy for them to sign up for the event.

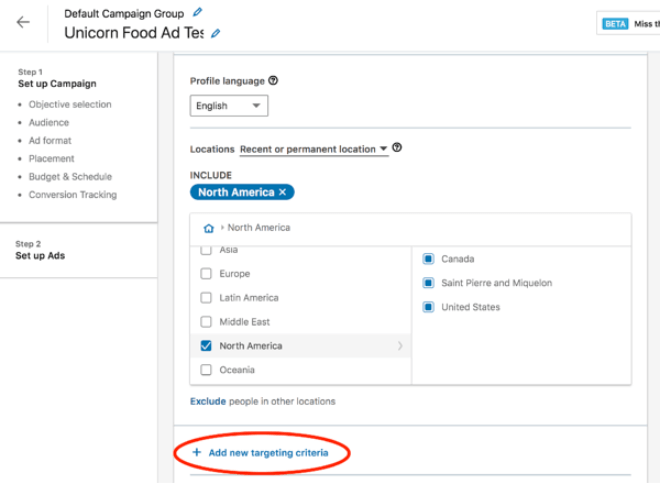

2. Audience

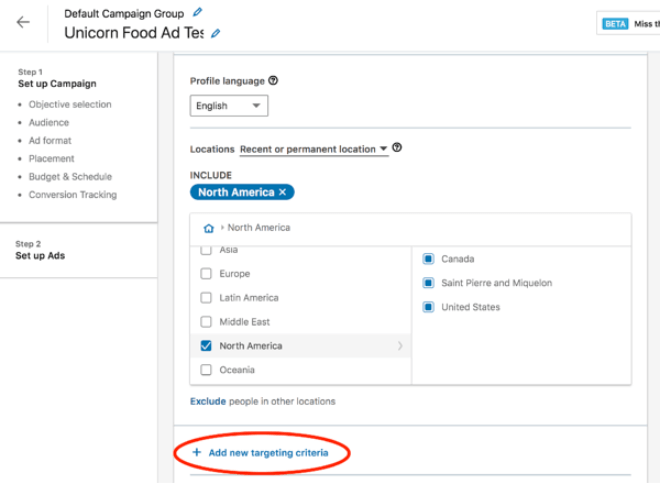

Next, you want to define your target audience. The more defined your audience is, the better your ads are going to perform. For this reason, it’s critical you pay careful attention to creating your target audience. Start by reviewing your client personas and then go through the setup window, choosing all the necessary options.

Once you’ve done that, click “+ Add new targeting criteria”, and you will be walked through the rest of the audience targeting wizard where you can enter in the rest of your ideal potential client’s demographic details.

3. Budget & Schedule

Next, you want to set up your campaign budget, scheduling, and bidding options. When it comes to budget, set a daily budget for what works best for your marketing budget. It’s important to remember that you want to start with a relatively small budget to test your ad. If after a few days you see it’s reaching your objectives you can then scale your ad spend. If it’s not though, starting small like this is a wise move as it saves you money and gives you the opportunity to create an ad variation you can test again.

For instance, suppose you want to run an ad campaign targeting high net worth executives regarding loan programs for income property. Rather than going all-in, in the beginning, you decide you are going to spend 30% of your daily ad budget for testing purposes. In that process, you find out that your target audience isn’t converting and clicking through the lead form in the ad. As an alternative, you create an ad about how low-interest rates are and how now is a perfect time to refinance their home. You test this ad and after a few days, you see that these executives are very interested in discussing refinancing their home. So in the end, if you hadn’t tested the ad first, you would have ended up spending your entire ad budget, getting no results and making the whole effort a wasted cause.

The take-home message here is test early and test often.

The scheduling section of the campaign set up is pretty straight forward. Choose a date for your campaign to start. You can indicate for your campaign to be shown continuously or ‘til an end date.

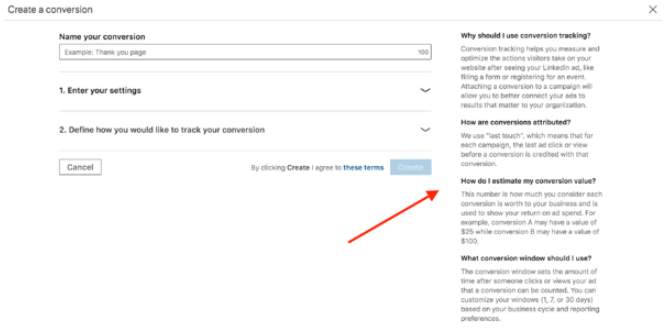

4. Conversion Tracking

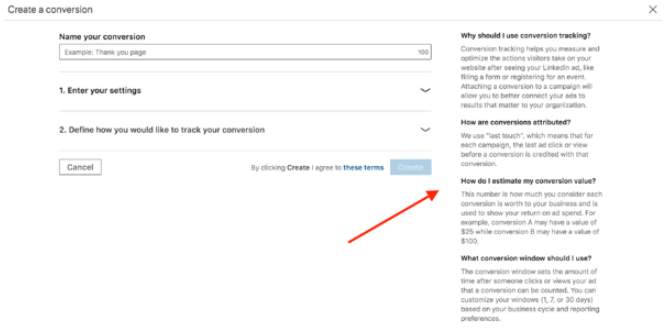

As they say, anything worth doing is worth tracking. For this reason, you need to set up conversion tracking for your LinkedIn campaign, which will track and measure the actions people take after clicking on your ads.

Click “+ Add conversions.” A new window will pop up, where you’ll name your conversion, choose your conversion settings, and decide how you’ll track the conversions. There is also a little “cheat sheet” that will pop up on the right-hand side of the screen that will give you really helpful instructions.

That’s it! You’ve set up your campaign. Now it’s time to move onto ad set up.

Ads That Will Help Grow Your Mortgage Business

So now that you’ve got the basics set up, let’s talk about some specific ad types and campaigns you can run that will help you build your brand awareness, generate more leads for your pipeline and establish you as the thought leader in your marketplace.

Single Image Ads

Single image ads are a great ad format you can use to drive traffic to places you want your ideal customer to go. As the title indicates, the ad consists of a single image and ad copy.

Let’s say that interest rates have dropped and you want to run a campaign about now being a fantastic time to refinance. You could use a single image ad to drive traffic to a landing page on your mortgage website to collect leads. It’s important to note that the refinance ads you run on LinkedIn do need to be different than the ones you are running on Facebook. Remember, LinkedIn is a business-oriented platform. As a result, you have to put things in the frame of a business setting.

By using imagery of corporate people in suits for instance, you can get people to relate to the imagery as they are undoubtedly pulled into way more meetings than they want to on a daily basis. Craft your ad copy to speak to some of the pain points your ideal client that is a corporate executive may be facing. For instance, maybe you have an automated system that offers a worry-free, easy home refinance. Conveying that in your ad copy and assuring them that they aren’t going to have to take time out of their busy day to look for extra documents, or even turn up at a title company to do a sign off are things that would capture their attention and likely get them to investigate more about your offering.

If you don’t want to lead a prospect to a landing page on your website, you can also choose to attach a lead form to the ad. The prospect can then click on a call to action button and a form with their information already filled in will pop up on the screen. All they have to do is hit submit, which makes the barrier of entry low, and may be a great way for you to pull more leads into your sales funnel.

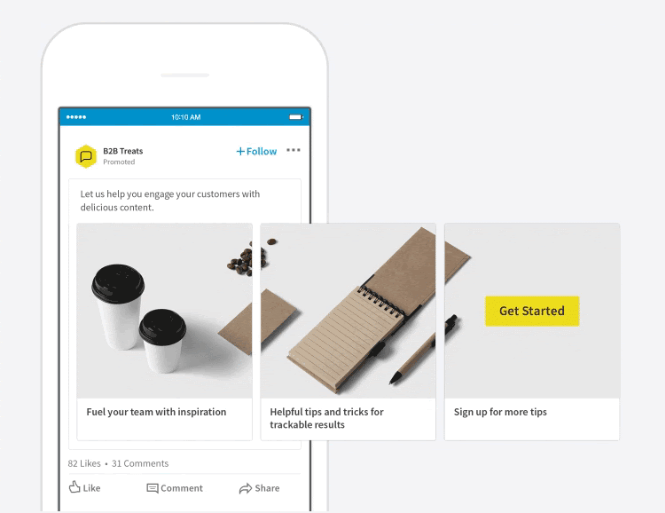

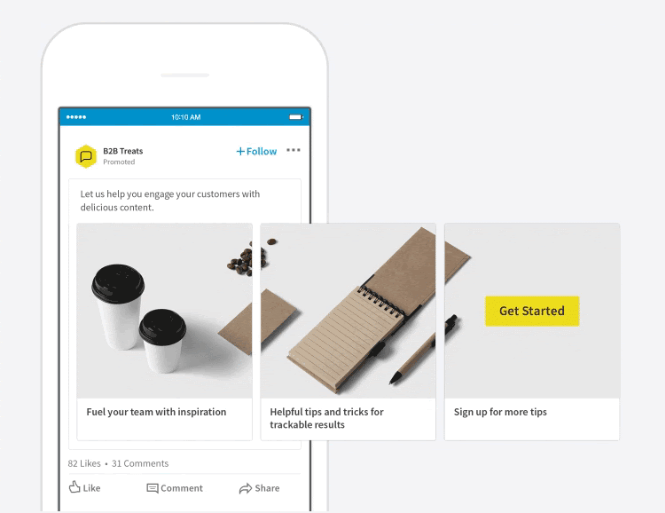

Carousel Ads

Storytelling is as old as time itself. People are so used to the formats of stories that marketers have actually been using them for years to help sell their products and services. Carousel ads give you a unique opportunity to tell a story about your mortgage services and engage with your ideal prospective clients.

Let’s suppose that you have created a state of the market report that you are using to target high net worth executives in your marketplace with the hopes of interesting them in refinancing their existing income property or perhaps taking out loans to buy more property. It’s a good chance that your ideal prospect is a busy person. They aren’t going to just click to read your report without knowing what’s in it. They also though probably don’t want to watch a two or three-minute video of you describing what is detailed in the report either. This is a great place to take advantage of carousel ads.

Choose 3 or 4 of the most important or interesting things covered in your report. Those 3 or 4 things are going to become your slides. Using a compelling piece of imagery that visually represents each point, and then using the captions below the image to craft a brief, compelling benefit about that point will lead your ideal prospect through the journey of why they need this information that you are willing to give them. The final slide has a call to action button, so when they get to the end of the carousel, all they simply need to do is click on the button.

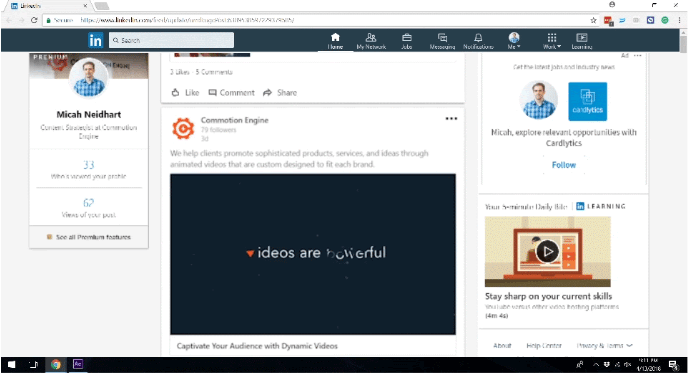

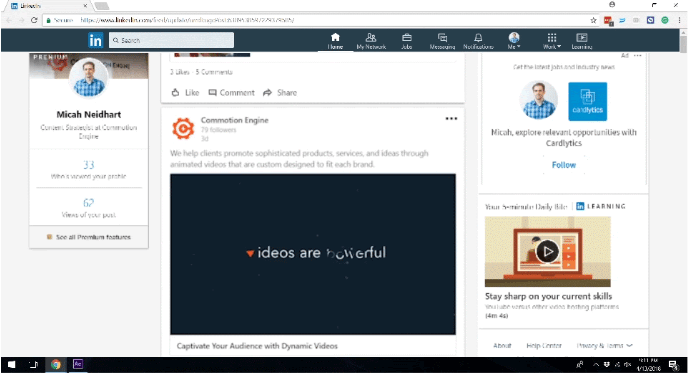

Video Ads

There is no doubt that video is a very popular format for ads in the digital space. On LinkedIn, the one important thing to always remember is this is a business platform and business people are busy. One powerful way you can use video in your ad campaigns is to think of it almost like you think of the carousel ads we just covered.

If you wanted to shoot a video where you are sitting in your conference room for instance and the purpose of the video is to try and attract people to refinance, thinking of the storytelling process that we described above, you can follow this format to make a brief, compelling video that will hook your prospects and get them to want to click your call to action button to learn more:

-Start by addressing their problem or challenge. For example, “Many business executives faced with having to refinance their homes are frustrated because it takes time away from their obligations.”

-Next, call out your company and how you can solve that problem. For example, “Your name Mortgage understands this and we’ve put together a fast-tracked, hassle-free refinance system that doesn’t require you to come to our office.

-Finally, call out how they will feel/what they will accomplish by doing business with you. For example, ”You’ll have more time, fewer headaches and be able to stay focused on the things most important to you”

Lastly, you always want to end with your call to action. Even though you’ll have a call to action button on the ad that says something like “Learn More” or “Contact Us”, be sure to close the video with a call to action phrase such as, “Click the button below to find out how we can help you”.

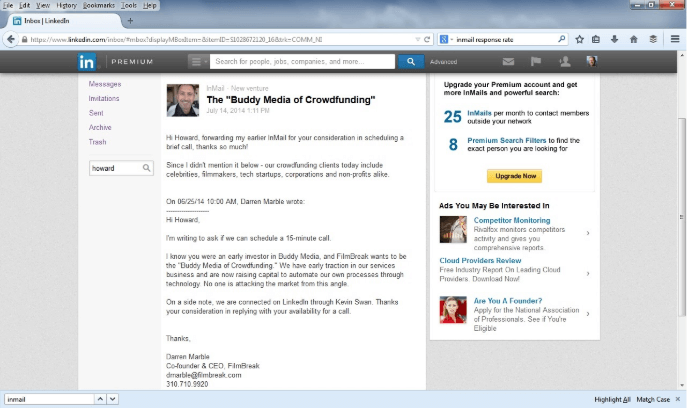

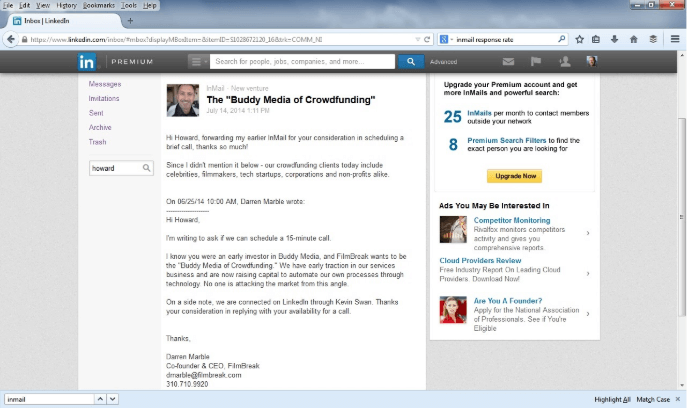

Message Ads

Finally, we have an ad format that you are probably most familiar with, even if you’ve never run a LinkedIn ad for your mortgage brokerage before. Message ads are just like the messages you receive from your LinkedIn contacts in your Inmail box day in and day out. The only difference is in this case you are able to pay to send messages to ideal potential clients that you are not connected to.

With this form of campaign the best practice is to treat it like any other business-oriented sales letter you would send. You’ll want to state who you are, why you are contacting the person, the value what you have to offer will bring them and a direct call to action on the next steps (e.g. let’s set up a time for a brief call).

PRO TIP: To keep the barrier of entry as low as possible, in your CTA requesting a time for a call, include a calendar link from a service such as Calendly.

Utilize LinkedIn Ads To Show Your Market Expertise

While it’s true that the setup process for LinkedIn ads may be a little more involved than your Facebook or Instagram campaigns, it’s important to remember that running ads on this platform gives you the ability to market yourself in a different way. The framework of LinkedIn is business-oriented. Because of this, you can dive deeper into market-related information, finance related information and really flex your “industry thought leader” muscles more than you can on other platforms. It’s a perfect way to diversify your marketing tactics and strengthen your overall position in the market. The more diversified you are, the more likely you are to generate leads, which will help you grow your brokerage.

Key Takeaways

Precise Targeting: LinkedIn Ads allow loan officers to reach a highly specific audience, targeting professionals based on job titles, industries, location, and more, ensuring your ads are seen by the right people.

Lead Gen Forms Simplify Conversions: LinkedIn’s Lead Gen Forms streamline the process of capturing and converting leads, making it easy for loan officers to gather contact information directly from the ad, improving follow-up efficiency.

Building Credibility and Trust: Loan officers can use LinkedIn Ads to share valuable content like client testimonials, case studies, and expert insights, which helps establish credibility and builds trust with potential borrowers.

Increased Visibility and Engagement: By leveraging LinkedIn Ads, loan officers can boost their online visibility, drive more traffic to their profiles and websites, and increase engagement with a professional, decision-making audience.

Commonly Asked Questions

How can LinkedIn ad objectives help mortgage brokers attract more clients?

LinkedIn ad objectives, like website visits, engagement, and lead generation, help mortgage brokers target specific audiences. For example, brokers can drive traffic to loan program pages, increase followers with engagement ads, or collect leads using pre-filled forms for events or services.

Check Out BNTouch’s Linked In Ads For Loan Officers Tools