Summary

This article offers a glimpse into future trends in the mortgage market, focusing on the year 2027. Learn about anticipated changes in technology, buyer behavior, and economic factors shaping the industry. It provides actionable advice for staying ahead in a competitive environment. By the end, you’ll understand how to adapt your strategies to prepare for upcoming shifts in the housing market.

Believe it or not, but 2027 is less than 10 years from now. Does that sound like a long time to you? Okay, does 2007 sound like a long time as well? Probably not. 10 years is 10 years no matter whether it’s in the future or in the past and seeing how quickly technology changes we can only wonder how consumers will buy and finance a home in the future. After all, it was in 2007 that the iPhone was first introduced and what are we witnessing now from Apple? That’s right, the iPhone X. From cryptocurrency to virtual reality to the iPhone XX, we’re virtually assured the home buying process will be much different than it is today.

Yet up until this point, the home buying process has pretty much remained the same. Automated underwriting systems began to take hold of the mortgage market in the late 1990s and today most all mortgage applications are approved electronically with very little human handling. Loan files are delivered digitally. You can fire up your computer and search for homes at your leisure. You can get an updated credit report in a matter of minutes. But still, finding, buying and financing a home is still a step-by-step process. Let’s peek into the future and what will change 10 years from now.

The Search.

Compared to other parts of the home buying and financing process, the physical act of searching for a home is by far the most fun. Compared to say documenting a loan application and sending in tons of paperwork, going shopping can be exciting. Today, the home search process typically begins with someone logging onto a website that hosts listings of various real estate agents. In the past, the multiple listing service was closely guarded by the real estate community but with advances in technology the utility of the MLS has long since vanished. Everything is online and search techniques have been refined to the point that a consumer’s search history over the past year for a variety of products and services can provide a list of areas that have homes in an area the future home buyer would like to live as well as within a comfortable price range.

For example, someone is nearing the age of 30 years old. Data indicates that’s the approximate age of a first time buyer. If that person is also married, the likelihood of someone starting a family or adding to an existing one is higher compared to older buyers. The quality of public schools is probably a priority. All this information and more is available to various bots which deliver a list of ideal properties which the buyers can qualify for. No more entering zip codes, price ranges or other demographic data. A complete list of homes for sale that matches the buyer’s profile is automatically presented and immediately updated when a new home is listed.

The View.

Instead of logging onto the internet and viewing different images, there is also an online virtual tour the future buyer can take. But in 2027, buyers slip on the latest virtual reality headset in order to take a personal, on-demand tour of a potential property. The headset isn’t a prerecorded presentation or message from the listing agent but instead fed live information about the property from a series of cameras placed in strategic areas throughout the house and surrounding areas.

Instead of driving to take a personal 3-D tour, this new technology allows consumers to take their very own walk-through without ever leaving the house in real-time. How is the flooring? Does the property appear to be in good shape and taken care of by its current owners? What the curb appeal and outdoor landscaping? Virtual reality tours give potential buyers more relevant information about a home before deciding whether or not to research further with a real estate agent.

The Research.

Today, researching the chain of title on an existing property means contacting a mortgage company who can make the request on your behalf and provide a Preliminary Title Report. In 2027 Chain of title can be easily accessed with a few clicks. When was the home first built and how many owners have there been? Are there any outstanding liens on the property other than a mortgage? When property owners get behind on the property or income tax liens can be filed and must be settled before the home can transfer from the seller to the buyer. Outstanding delinquent taxes can indicate someone having financial issues over a relatively extended period which would indicate the owners couldn’t also afford to properly maintain the home.

Loan Approval.

Today, the mortgage approval process is closer to a “one click” approval than ever before. When applying for a mortgage, not only will the consumer give permission to the lender to pull a credit report and credit scores but also access bank accounts and employment history. Instead of providing copies of bank statements, paycheck stubs and tax returns along with an initial loan application, financial data is gathered electronically and documented later.

In 2027, the loan approval process is automatic. Digital copies are the norm and physical paperwork is history. When applying for a mortgage all relevant data is accessed automatically and an approval issued. All the buyer needs to do is decide which house to buy and what type of loan suits best.

Communication.

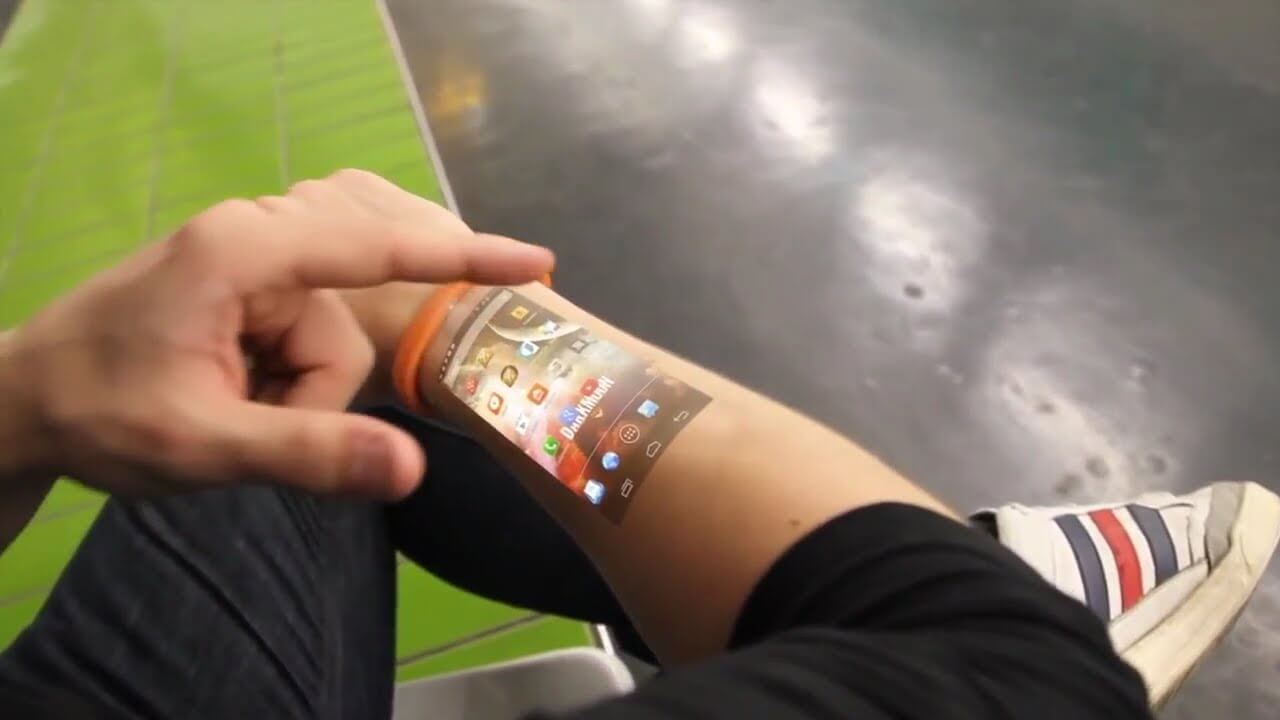

The loan officer will provide various loan options that meet the buyer’s criteria and help with picking out the right loan program. What will change is the ease of communication with all relevant parties. In 2027, Siri and Google Home have evolved over the past 10 years and can connect you with anyone at any time for any reason. Mobile phones have changed into wearable technology and all you need to do is speak. Conversely, you can also restrict when you want to receive communication and from who. If interest rates suddenly change, your loan options along with new monthly payments are automatically updated without having to call your loan officer for rate updates.

Blockchains.

Blockchain technology has technically been in existence since around 2009 but fully developed and evolving in 2027. A blockchain is a peer to peer digital application that reduces the need for third party interactions. When a buyer purchases a property there is no longer a traditional deed with title information recorded and distributed on paper, for example. Instead, the buyer is provided a digital token proving ownership and legal transfer of the property. Real Estate and Mortgage blockchains will have all previous real estate transactions stored for all licensed real estate agents and loan officers and helps identify experienced, trusted professionals while also identifying less experienced loan officers and agents due to the recorded transactions for any specific property.

Key Takeaways

- Prepare for Market Shifts

Anticipate changes in buyer behavior and economic trends shaping the mortgage landscape.

- Leverage Advanced Technology

Adapt to emerging tools and innovations to stay ahead of the competition.

- Understand Future Buyer Needs

Stay informed about evolving customer expectations to refine your strategies.

Commonly Asked Questions

- How will the housing market change by 2027?

The market will evolve with economic trends, new buyer expectations, and advancements in technology.

- What role will technology play in 2027’s housing market?

Advanced tools will drive efficiency, improving both buying experiences and industry operations.

- Why is understanding buyer needs crucial for 2027?

Adapting to changing demands ensures businesses remain relevant and competitive.

- What should industry professionals prepare for by 2027?

They need to embrace technology, monitor market trends, and adapt strategies to shifting customer behavior.